Part II - Payments in India - #OpenSourceFS

Published on 3 Feb 2017 ⸱ 10 min read ⸱ 148 views

Transactions are at the very heart of an economy and Payments power those transactions. India's Financial Sector has seen sweeping reforms post 1991, especially in the banking sector. However, the population is still largely under served when it comes to access to basic financial services. With emerging technologies and growth in telecom infrastructure, Financial services and products can be made available to the masses at low costs.

India’s economy is largely driven by cash. The payments industry is estimated to be around USD 15 Trillion_1_ of which a mere 5%2 payments are made through non cash mechanisms (Digital Payments). Printing and distribution of cash costs the economy ~1.7% of the GDP_3_ per year. India’s digital payments processing infrastructure has been close to dismal in the past. However, adoption of digital payments has seen a huge growth in the past 5 years. Convergence of events such as advances in technology, deeper penetration of telecom networks, access to high speed mobile data have resulted in increased adoption of digital payments.

Post demonetisation of 86%4 of India’s cash by value, the Government of India has introduced several incentives to further accelerate adoption of digital payments

Market size:

+ India Market size (2015) - USD 15.5 Trillion. 95%2 of payments are transacted through cash

+ Paperless Transactions (Digital) 2: India – 5%, USA - 45%, Brazil - 15%, China - 10%

What are Payment Gateways:

+ Payment Gateway is a merchant service that enables payment acceptance/authorisation for merchants by aggregating various payment mechanisms for the end user (merchant’s customer). Payment gateways typically earn a percentage of the total transaction amount as commission for enabling/processing the payment.

+ Payment Gateways will continue to remain relevant in the future for the following reasons:

> Growing Number of Payment Mechanisms: With the growing number of payment mechanisms, merchants find it difficult to keep track of successful transactions from each mechanism at the end of each day/month. Payment gateways makes it easier for the merchant to accept payments from any mechanism while maintaining a consolidated dashboard of all successful transaction. With growing methods of payment acceptance, merchants will continue to require a payment processor (payment gateway) to accept, process, settle and report all transactions.

> Prevention of Fraud and Security: In the financial services industry, fraud and security risks are the highest. Payment gateways need to be proactive about its fraud detection technology and security breaches to protect, not just the merchant but also the consumer

> High costs to maintain large scale payments Infrastructure: Costs involved in building a highly available, fully functional, secure payments network for the scale of India’s population will be huge. Immediately post demonetization, card networks and ATM servers faced massive outages because it couldn’t handle the high demand6. The more decentralized the infrastructure (more payment processors) the lower the costs and better the service.

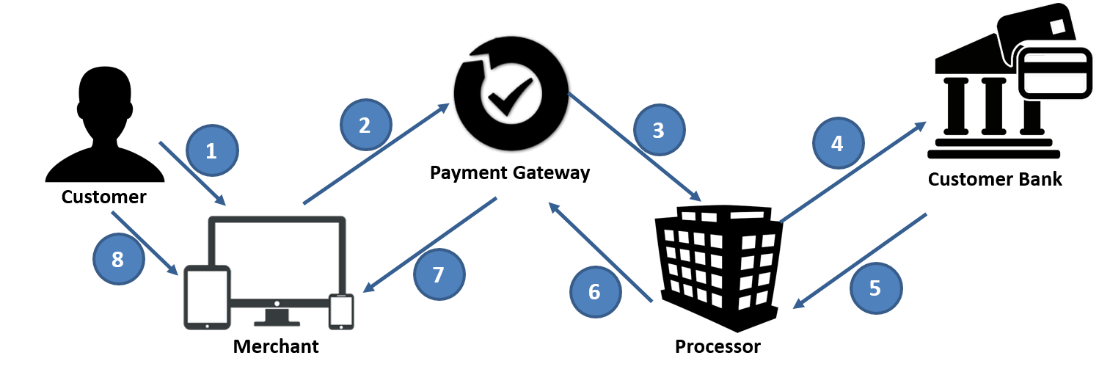

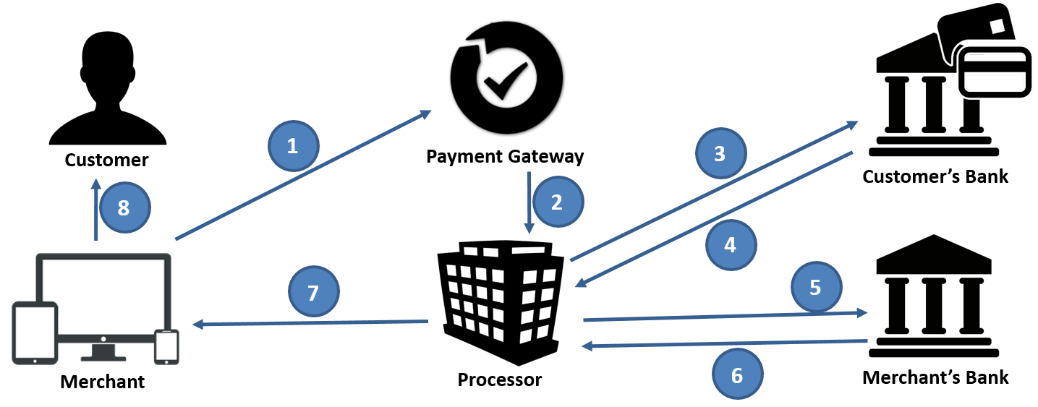

How do Payments work? Payment Settlement is a two step process

+ Authorisation Process

+ Settlement Process

+ Commission Split: Broadly, a digital payment commission is split in the following manner. Please note, the below split is a close illustration and not exactly how payment commissions are split. Commissions vary depending upon the payment volume, type of payment and a lot of other parameters.

| Who Earns How Much? | Transaction Cost | Value (INR) |

| Assumed Product Price | 100.00 | |

| Transaction Cost | 2.00% of Product Price | 2.00 |

| - Issuing Bank Commission | 60% of Txn Cost | 1.2 |

| - Acquiring Bank Commission | 20% of Txn Cost | 0.4 |

| - Switch Commission (VISA, MC etc.) | 10% of Txn Cost | 0.2 |

| - Payment Gateway Commission | 10% of Txn Cost | 0.2 |

> Transaction costs vary between 1.00% to 4.00% across different Payment Gateways (e.g. BillDesk, CCAvenues etc.) and across payment types (e.g. Credit card, Debit card, internet banking etc.)

> An average 2.00% transaction cost is mentioned above for illustration purposes

> Transaction cost between Customer Bank and Payment Gateway is negotiable. Higher the Transaction Value, lower is the transaction cost to the bank

> The Payment Gateway margin as shown as 0.20% above, can thus be increased by increasing Gross Merchandise Value (GMV)

Payment Mechanisms: India has many Payment Mechanisms, low literacy on usage and lower number of acceptance points. Below is a list of India's payments mechanisms.

+ Cash

+ Cheque

+ Card Networks (VISA/Mastercard/Diners Club, Discover, AmEx etc.)

+ National Electronic Funds Transfer (NEFT)

+ Real Time Gross Settlement (RTGS)

+ Immediate Payment System (IMPS)

+ Electronic Clearing System (ECS)

+ National Automatic Clearing House (NACH)

+ Prepaid Payment Instrument (PPI)

+ Unified Payments Interface (UPI)

+ RuPay (Card Network)

+ Aadhaar Enabled Payment System (AEPS)

+ Bharat Bill Payment System (BBPS)

+ *99# (USSD)

Here's a helpful map of India's payments infrastructure:

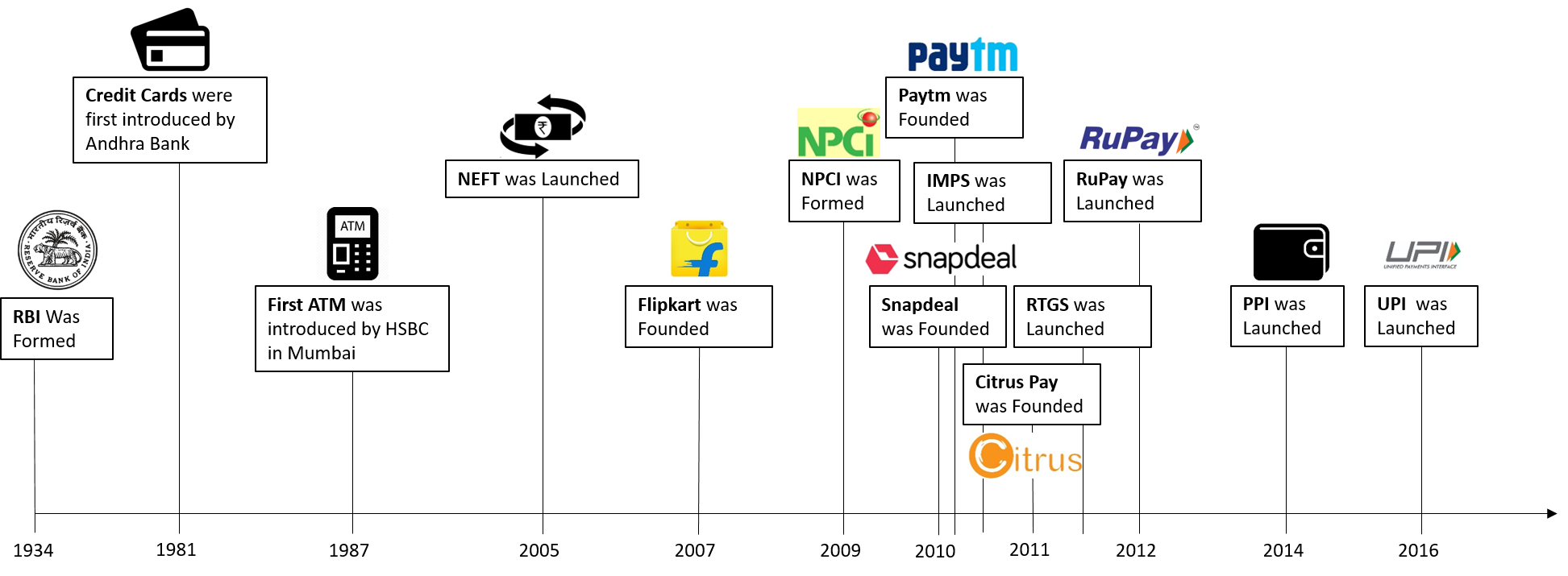

Evolution of Payments in India

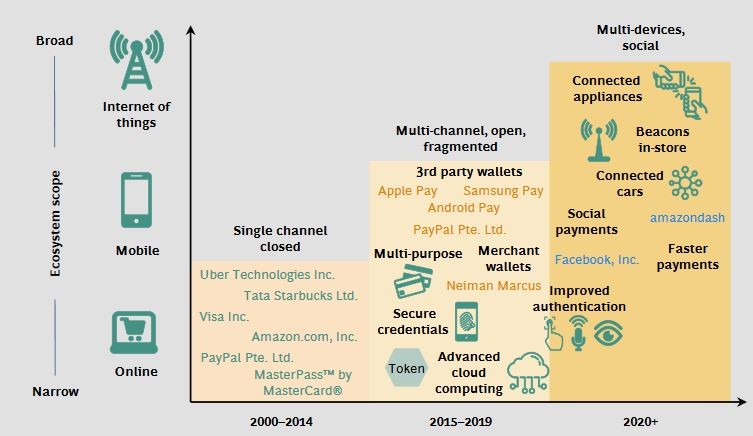

Evolution of Payments Globally (Source: BCG Report)

Business Models – Business Models classified on end customer acquisition basis

+ Business to Consumer (B2C): e.g. Paytm, Citrus, PayU Money, Freecharge, Mobikwik etc.

> Multiple revenue streams: Cross sell various products i.e. personal finance, ecommerce, tickets etc.

> High Exit Value: An investment in this space will get a high value, provided the customer base is large

> High Cost of Customer Acquisition (CAC): High cost of marketing, discounts & cashbacks to entice customer to the service. The high CAC will be sustained over long periods to gain customer loyalty

> High Fraud and Security Risks: Creative customers find it easy bypass security features. High cases of fraud have been reported in PG’s of this model

> High cost of expanding to different geographies: Expansion beyond home geography means replicate an already high cost customer acquisition strategy

+ Business to Business (B2B): e.g. Airpay, CC Avenues, BillDesk etc.

> Merchant Acquisition is a long process: Merchants have to be acquired one at a time to maintain scalability of the technology. Merchants can be divided into three buckets: low yearly turnover (INR 10-50 Cr), Mid yearly turnover (INR 50 to 2,000 Cr), high yearly turnover (INR 2,000 Cr and above)

> Sticky Client base: Although merchant acquisition takes long, once the merchant has migrated all payment acceptance to the payment gateway, it is difficult for the merchant to migrate to another PG

> Pooled Fraud Detection Capability: With a large merchant base with lacs of consumers transaction daily, the PG can pool resources and build fraud detection capabilities within the technology stack. This is a huge advantage over B2C fraud detection capability

> Low Cost of Geographic Expansion: Cost of expanding to different geographies is low but time consuming. The process will have to be replicated brick by brick. By building a brand of payments, this time lag can also be reduced considerably

+ Business to Bank (B2Bank): e.g. BonusHub, PineLabs, LivQuik etc.

> Bank acquisition is a long process: Acquiring banks as customers is a long process as they have existing relationships and vendors. Technology needs to be radically unique to be accepted by banks

> Lowest cost of Merchant Acquisition: Merchant acquisition is done by the banks at their cost with a large acquisition machinery. In effect, the PG gains significant traction with merchants at virtually no cost

> Chances of High growth: With the Bank leading the charge for merchant acquisition, the PG is highly dependent on the bank’s sales force for growth. Revenue on a transaction commission will take a longer time to gain some traction. Most PG models for banks currently have a licensing revenue model.

Concluding Thoughts on Payments in India

+ The payments sector is more mature and technologically advanced than the rest of the financial services industry

+ Startups in ecommerce and payments have contributed to increased adoption of digital payments. Payments startups have creatively used existing payments infrastructure and mechanisms to build innovative methods/layers of accepting payments e.g. QR code, auto OTP detection, sound wave payments, NFC cards, among others.

+ Post demonetization on 8th November, 2016, the push for digital payments has gained significant traction

+ Adoption of digital payments has accelerated by at least 2-3 years post demonetization. Incentives provided by the government is only an impetus to accelerate adoption of digital payments by the bottom of the pyramid

+ With growing number of payment mechanisms, the consumer will continue to pay in the manner that s/he is most comfortable with. One cannot expect every consumer to move to any one payment mechanism, no matter how cheap it may be to transact. Drivers for use of preferred payment mechanisms will be: discounts, cashbacks, loyalty points, payment experience, regulation, security, convenience etc.

+ Transaction costs for all mechanisms will continue to reduce for the next 1-2 years primarily to drive adoption of digital payments. Transaction costs will, however, increase with increased digital payment adoption as costs to maintain payment switches and infrastructure will not justify low costs

+ A payment gateway that is agnostic to payment mechanism will continue to be relevant in the future

+ Security and Fraud will continue to be a risk with increased adoption of digital payments. A Payment Gateway will have to provide a proactive technology stack to its customers (merchants, banks or consumers) and mitigate these risks

+ It is often said that innovation precedes regulation. The Payments sector is the one of the few sectors where regulation is far ahead of innovation. Innovation will catch up.

+ It is the most interesting space for investments as things stand in the financial services industry

+ The opportunity in the payments space is the immense scope of disruption for the next billion Indian’s that are going digital. Most startups are targeting the couple of million Indian’s that are in the metro cities.

+ The payments sector is not a “winner takes all” market. It is large enough for multiple large platforms to be sustain profitably in the industry

+ A winning business model will be one with low customer/merchant acquisition cost and one allows the merchant to be agnostic to payment acceptance mechanism or medium

Would love to hear your thoughts on the payments industry in India. Write a comment below or email me

Onward.

You can read other posts from this series (#OpenSourceFS) as below:

- Part I - Open Sourcing FS or the need for it's disruption

- Part III - Peer to Peer Lending

- Part IV - Banking 2.0

___________________________

References:

- RBI Estimates, 2015

- MasterCard Cashless Report, 2016

- Visa Accelerating the Growth of Digital Payments in India: A five–year outlook., 2016

- RBI Data Releases, 2016

- JM Financial Report on Jan Dhan Accounts

- Times of India news article

- Personal Analysis

Note: All blogs posts till 2022 were migrated to this platform (react+next+tailwind). While all efforts were made to migrate wihtout any loss, the migration lost some images and broke a bunch of links in old posts. If you spot anything amiss, please notify me?