Part IV - Banking 2.0 | #OpenSourceFS

Published on 4 Mar 2019 ⸱ 8 min read ⸱ 112 views

When was the last time you visited your bank branch? If you did recently, how was your experience? Were you able to get your issue resolved within the first visit? Forget your branch experience, when you made an online payment transfer from your bank account, which method did you select? IMPS? NEFT? RTGS? UPI? Do you know what these mean? In your bank statement have you checked what charges your bank is levying on your account? Do you know what those charges were for? Did you get a notification regarding these charges? When you contacted customer support, were you able to get your problem solved without being pushed to purchase another product? How about the time when you tried applying for a loan from the bank you have an account with, did you get one pre-approved? Did you have to resubmit all your documentation, including bank statements, again, despite being a long time customer with the Bank?

One can probably relate to most of these experiences when it comes to banking. I'm guessing this is not just an India problem but banks worldwide are clunky with a broken experience. And this is just the retail side of things. The SME banking side is another devil to solve for, but that's not what this post will be about. Customers trust banks with their hard earned money and it's the bank duty to provide a frictionless experience to their customers. Sure, banks have costs of management and regulations to deal with but I don't think that's a formidable reason to be clunky in operations. We are living in 2019, things ought to be better, easier and more efficient. Gosh, this is almost seeming like a rant but bear with me here for some time. We need banking to change.

I'm not saying Banking needs to change primarily to adopt technology and provide fancy features. No. Banking needs to change because even to this day, there are over 3 Billion people across the world that are not included in the financial system. 1.7 Billion people still do not even have a financial account. To this day, Financial Inclusion continues to be a focal point for regulators, impact investors, non-profits and so on. It's baffling that access to basic financial services is still being talked about when it should have been default. CGAP (Consultative Group to Assist the Poor) had released a very informative deck called Branchless Banking 101 covering what it is, why it's needed, it's basics among other things. That deck was released in 2012 and is still relevant.

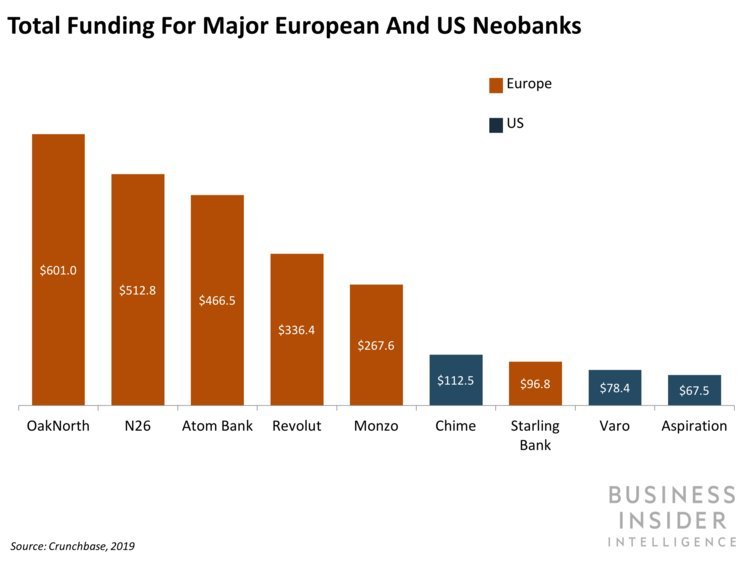

World over, new age, technology driven banks are cropping up - dubbed Neo Banks or Challenger Banks. Personally, I don't like the term challenger banks, but who cares. Banks like Monzo, N26, Chime, OakNorth and so on are largely technology-driven, branchless banks. A bunch of them even raised a ton of funding (see chart below). Even incumbents are getting on the bandwagon and launching their own versions of neo banks e.g. Marcus by Goldman Sachs and Finn by Chase. A lot of this analysis is ignoring what is happening in China but that requires it's own post. There's a fairly detailed analysis on the European neo banking space made by Orange Digital Ventures. It covers a range of topics in detail and hence makes for a good read.

In India, the Reserve Bank of India has opened up banking licenses by willing to give it to credible names/groups that apply for one, obviously certain criteria needs to be met. This RBI notification came in April, 2016. It's been close to three years and not one new application has been made. This is the chance we have to truly disrupt banking as we know it. In fact, I will even go as far to say that banks of the future will not come from any existing financial institutions. Instead, existing technology conglomerates e.g. Amazon, Google or even Facebook will be driving banking products adoption and its growth. In India, things may not be as disruptive (hope I'm wrong here) and we may see existing banks reigning power or new banks coming from Jio, Future Group, Godrej and so on.

Areas where I see Neo Banks in India can possibly change the game are the following:

Banking Consumer Life cycle and Support: Consumer on boarding activities including account opening, documentation, eligible (personalised) service offering and so on can be made entirely digital, automated and without a branch-led operation. What this does is, reduces the cost of account opening and radically changes account opening numbers and therefore improves financial inclusion. Thereafter, retail consumer account management including service requests, grievances, transaction initiation and execution, all can be managed remotely and digitally. Grievance management as well doesn't require physical branches (which is what most branches are for). The same can be achieved via centralised video call centres. Thereafter, cross selling other bank products e.g. personal finance, family banking, insurance, wealth management and so on can be managed with technology. This effectively means building appropriate logic in the technology stack to manage 360 degree view of the customer while being managed remotely and centrally.

Transparency in Costs and Policies: Banking today is largely broken because of the mountain of financial jargon we've put in policies that continually evolve without any notice to consumers. Retail consumers as it is don't understand the jargon but we've not stopped there, we continually improve it to make it tougher to understand. Moreover, banking cost schedules and method of charging consumers, today, works more like legal theft - for lack of a better word. It's an antithesis of what banking should be but you never get notified when your bank charges you for making a payment, for not maintaining a minimum balance, credit card fees and so on. It's only later, if and when you do check your bank statement and you actually understand it, that you realise you've been charged by your bank. There's a massive consumer loyalty to be earned here just by making a bank statement human comprehensible.

Payments needs to change: All the different payment systems needs to be abstracted at the retail end (front end) and logic can be built internally to the system to recognize the mode of payment (UPI, Credit, Debit, Net Banking, RTGS, NEFT, EMI and what have you) automatically. It's almost exhausting how many payment modes there are. Why put the onus of dealing with the different payment modes on the customer? Abstract it. Let the consumer enter the details of the entity they want to transfer money to and the amount. That's it! Technology should be able to identify the appropriate mode of payment and get the job done. Payments should work like this, out of the box, even for international payments. I know there are technical difficulties around achieving this, but it's not impossible.

Customer Interaction: Indian consumers have different backgrounds with different languages every few hundred kilometers you go. If one needs to build a truly mass banking product that furthers financial inclusion, it has to be in their language and in voice. The neo bank has to be incredibly accessible and centralised to know complete user history. Interaction is more meaningful when you have data to address the problem. Further, most ATM's are in either English, Hindi and one regional language (maybe) and yet even those are excruciatingly difficult to use. The user experience (let alone the user interface) of an ATM is too complex for first time users (large market) in India that they are deterred from using an ATM ever again.

Banking, today, thrives on complexity. Complexity in policies, pricing, regulation, business models and so on. Last I checked (01st March, 2019), the Banking industry in India (22 - public and 20 - private sector) had a combined market capitalisation of ~USD 285 Bn. That's a massive (shocked me as well) industry built on archaic and complex systems, processes, business models. Imagine how large we could make it if we could reach every Indian, touch every financial transaction and be more efficient with data.

Would love to hear your thoughts on this. Please comment here or email me.

Onward.

You can read other posts from this series (#OpenSourceFS) as below:

- Introduction to Open Source Financial Services (#OpenSourceFS)

- Payments in India

- Peer-to-Peer lending

Additional Reading:

a. If you're looking to read something smarter than what you just read above, read this McKinsey report on Neo Banking titled "A bank branch for the digital age" published in July, 2018.

Note: All blogs posts till 2022 were migrated to this platform (react+next+tailwind). While all efforts were made to migrate wihtout any loss, the migration lost some images and broke a bunch of links in old posts. If you spot anything amiss, please notify me?