Venture investing is hard

Published on 30 May 2025 ⸱ 5 min read ⸱ 63 views

I've been investing for 12 years now. I've done investments from pre-seed to series C i.e. $100K to $20M individual cheques. By far the most challenging, the most fun and the most fullfilling stage is early stage investing - for me.

But early stage investing is ridicidulously hard - no/limited data to invest on the back off, you have to find trends before they become trends, long validation cycles - you name it, everything is/will work against you to have a great outcome.

The problem with investing in general is that most people believe they can do your job better than you. But that's simply not true. It's very tough to transition from doing early stage investing to doing growth stage investing. You need a mindset shift, which very very very few people are able to do.

Literally yesterday (29th May, 2025), at an event, a founder told me my job is not a real job and that it's actually a side hobby. ¯_(ツ)_/¯

Even for me, because early stage investing is my job, I kinda know how hard it is, especially to generate returns. But I never really understood how hard it is backed by data. Even for the legends of early stage investing, the strike rate is quite low.

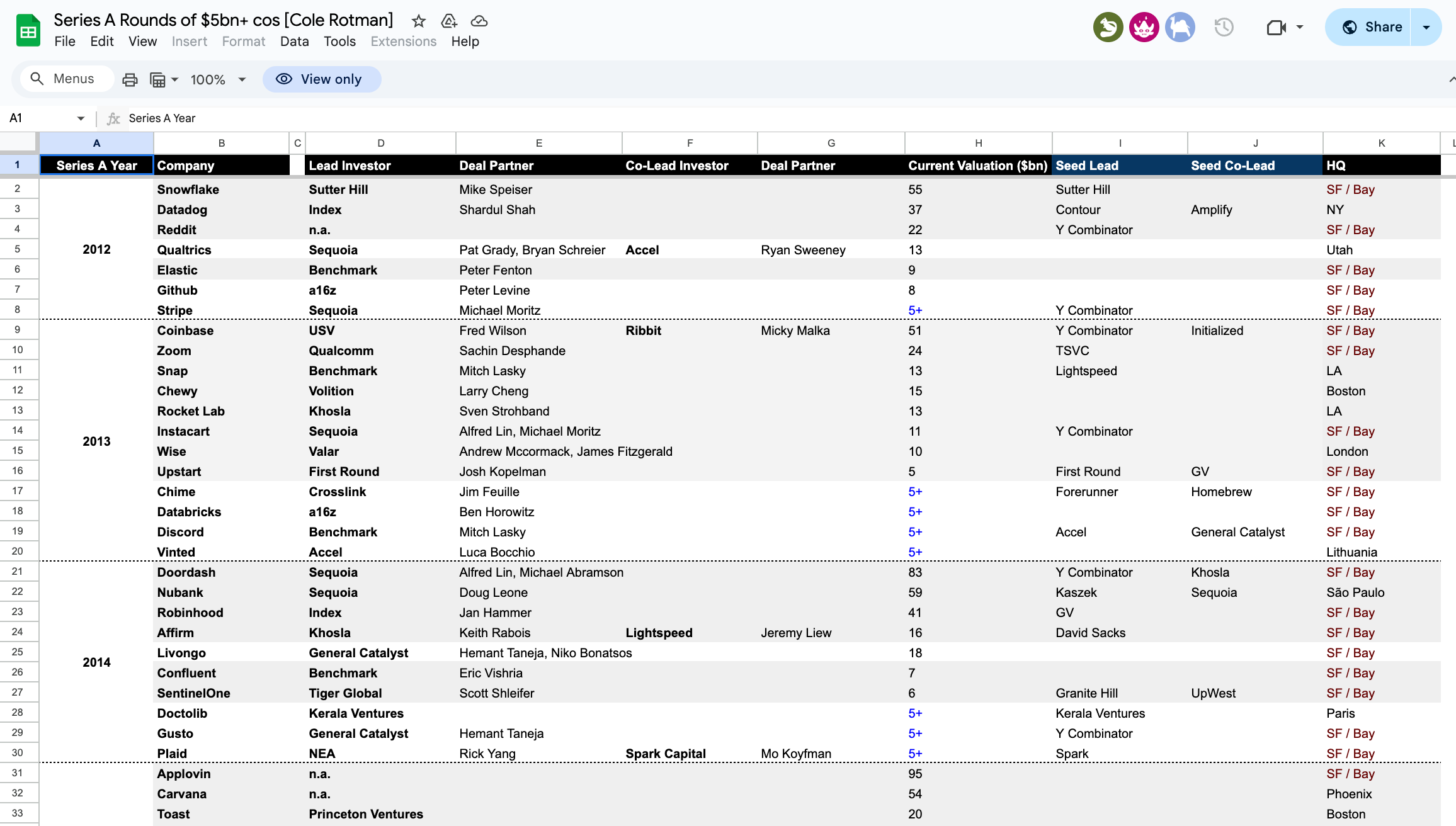

Came across this google sheet. I believe it's by Cole Rotman, investor at DST Global, because that's the name written on the google sheet. (correct me if I'm wrong)

This sheet has the list of all startups currently valued at $5Bn+, with the names of investment firms and General Partners who led the Series A round. The list has data from 2012-2024.

The data seems simple but has some surprising insights.

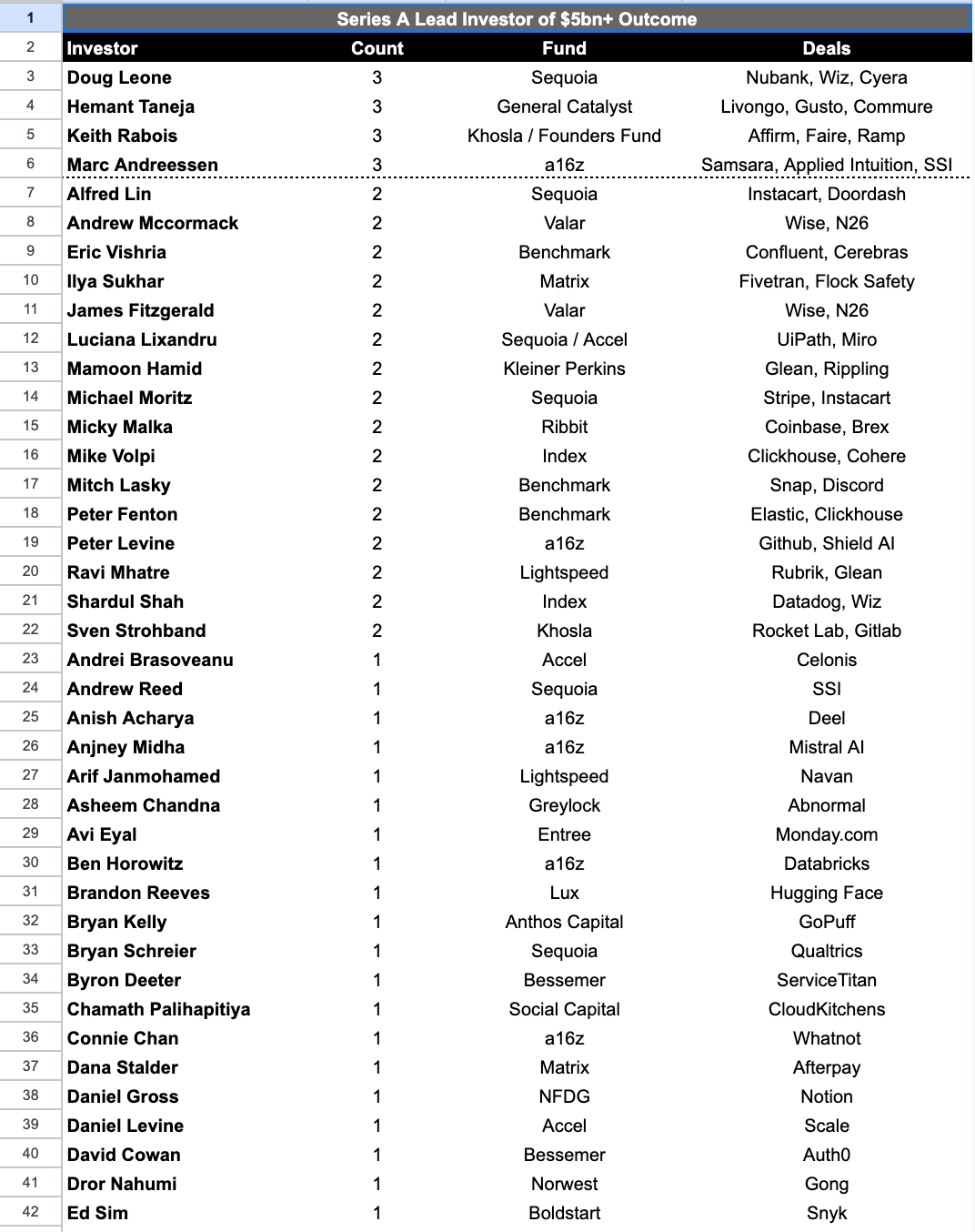

1. How many individual investors do you think have 3 or more companies where they invested at Series A and are currently valued >$5Bn?

10? 15? 20? 5?

Correct answer: 4. Just four legends Doug Leone, Hemant Taneja, Keith Rabois, Marc Andreessen covet this title in the Hall of Fame.

Do you want to hazard a guess as to how many investors have generated more than 3, >$100Bn valuation outcomes? One. Just one person - the legend Masayoshi Son.

(Safe Superintelligence (SSI) is a recent blow up with no product yet, so not sure it should be counted yet, but who am I to judge.)

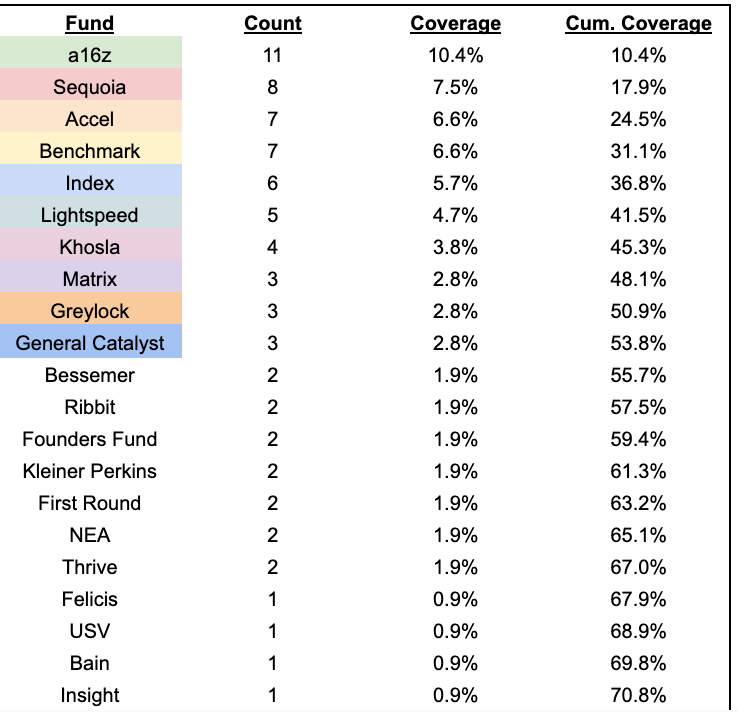

2. Is there any concentration in the return performance

Correct answer: yes!. The Top 10 VC firms accounted for ~54% of these outcomes. The Top 21 VC firms accounted for 71% of these outcomes.

The top firm i.e. a16z, accounted for 10.4%. This means that while there is concentration, broadly speaking, even the largest firms like a16z are missing out on 90% of the unicorns/outcomes.

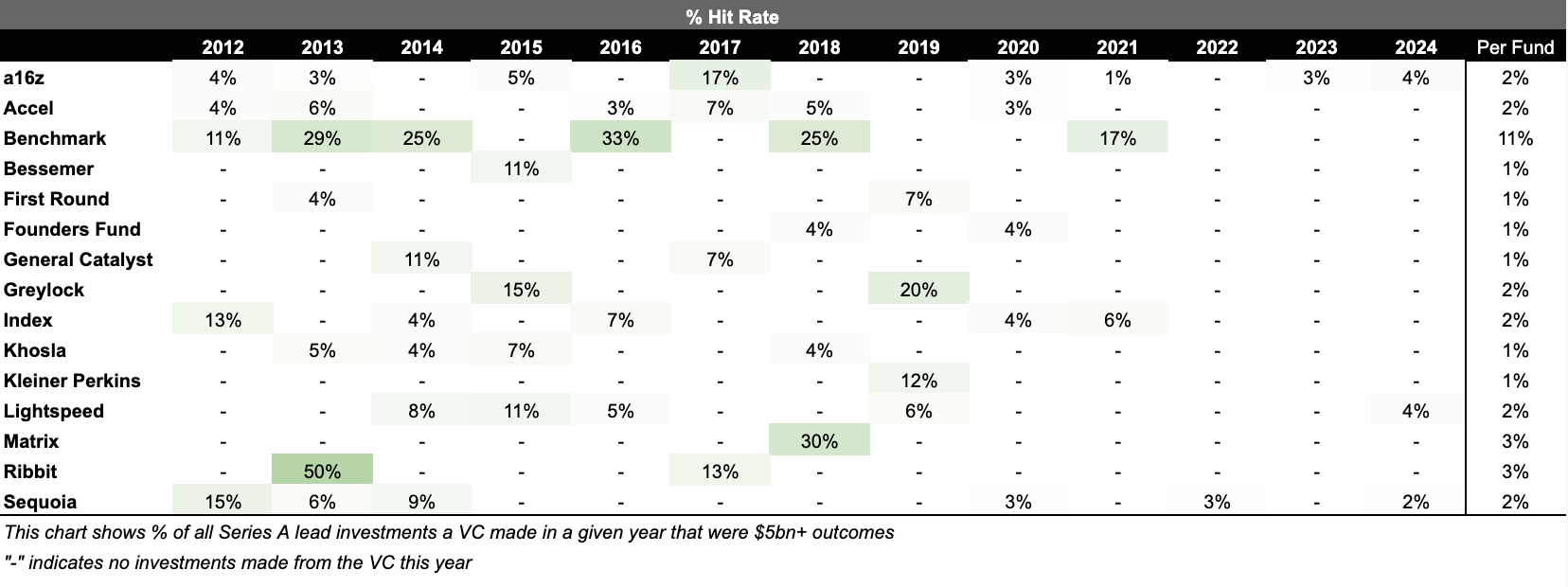

3. What's the hit rate of these firms?

Hit rate is the outcome (>$5bn current val, invested at Series A), of total Series A's completed by the firm. Sort of like benchmarking the firm against itself.

5%?, 7%?, 10%? more? less?

Correct answer: 3%. On average, only 3% of all Series A investments across each firm are generating a >$5bn outcome. Wihtout benchmark's performance, that number drops to 2%.

This is hard data that shows it's very very very difficult to be a conviction-led, early stage investment firm.

Why is the $5bn outcome looked at for this analysis?

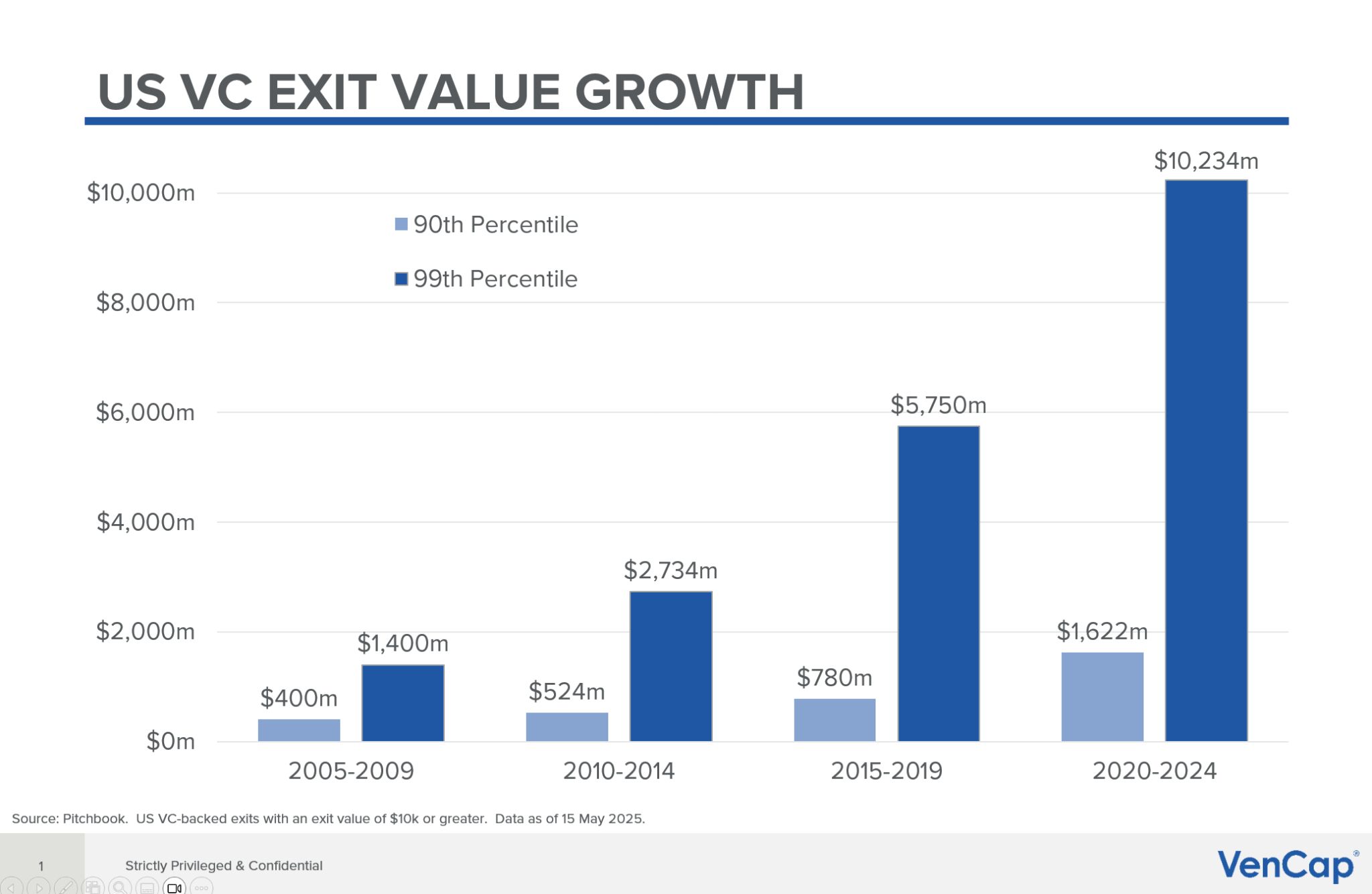

I can't speak for Cole Rotman, but I'm assuming it's got to do with the fact that a >$1bn outcome is not 99th percentile anymore.

Based on this analysis by VenCap International, if you're investing today, 99th percentile outcome is $10bn or more in valuation. But the earlier you invest, the more outsized your outcome at this 99th percentile... giving you Hall of Fame status.

The other question is "why series A". Series A is an odd stage. On the one extreme, you're not just investing in the vision or the founder which a seed investor does at seed stage. Arguably, one could spray and pray and still get a decent outcome.

And on the other extreme you're also not investing in a growth stage company where metrics are relatively stable etc. This stage is relatively formulaic and mathematical.

At Series A, you're investing when there's some PMF, some traction, some metrics, but it's not just a spray and pray on founder background and vision. At this stage, you also don't have too much data go on like you would at growth stages. Series A is arguably tougher than Seed or Growth stages.

I'm playing this game to hopefully be the best. The more you know, the more you know how/what to optimise. As one of my mentors/advisors told me recently...

Note: All blogs posts till 2022 were migrated to this platform (react+next+tailwind). While all efforts were made to migrate wihtout any loss, the migration lost some images and broke a bunch of links in old posts. If you spot anything amiss, please notify me?