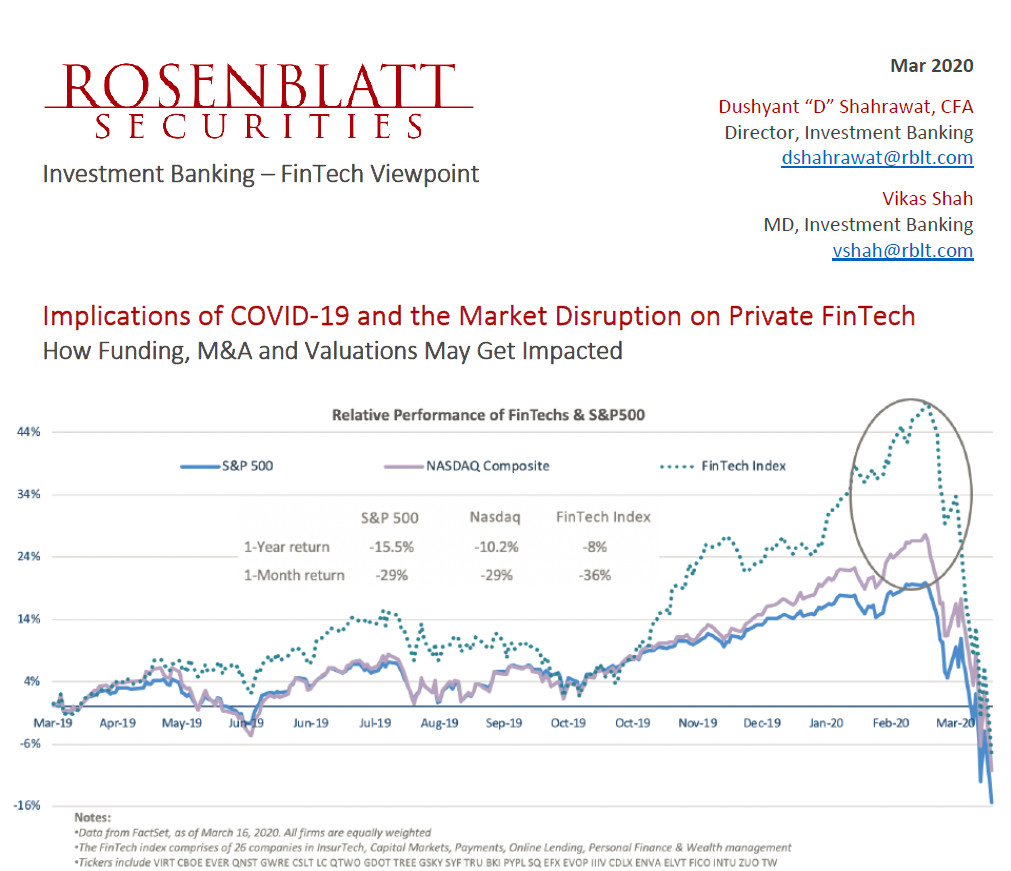

[REPORT] Implications of COVID-19 and the Market Disruption on Private FinTech

Published on 5 Apr 2020 ⸱ 3 min read ⸱ 37 views

Rosenblatt Securities released a really insightful, data-backed report on implications of Covid-19 and market downturn on the Fintech sector. A lot of what they say makes a lot of sense, but when they get into specifics, I don't agree with everything. You can decide for yourself by reading a short summary below or downloading the report and reading it yourself.

Needless to say that the data and implications are primarily forecasted for the United States market, but largely applies to Fintech's in other regions too.

Summary of the Rosenblatt Report

- Likely deterioration in fintech operating performance during a deep downturn, as funding sources evaporate and exit options change significantly

- These forces may feed off each other, creating a vicious cycle where deteriorating business performance makes funding more difficult and vice versa, should the market downturn last long

- A large proportion of private fintech firms are less than ten years old and facing their first market downturn. Many management teams may be inexperienced in responding to difficult business conditions - weak customer demand, working capital squeeze, and a tougher environment to retain employees.

- Fintechs with lower fixed costs will outperform and gain favor with investors over those with big, rigid fixed costs

- The flexibility in business models and the ability to dial-up/down costs will become critical for fintechs and will determine which firms survive

- Firms that rely heavily on large marketing expenditures to generate growth will come under investor scrutiny as they can no longer justify large customer acquisition costs due to weak transaction volumes

- Traditional financial institutions will gain a competitive advantage over fintechs in this highly uncertain market environment as they are better capitalised, have bigger brands, and benefit from customers becoming more risk-averse

- Fintechs with recurring revenue and long term contracts will be impacted less than firms with transaction-based business models

- As funding sources dry up, struggling fintech firms may be forced to seek collaboration, investment, or acquisition by traditional financial institutions, PE funds, or even non-financial strategic buyers

- Online alternative lending, digital wealth management, and consumer banking are sectors most likely to see M&A deals as incumbents use strong balance sheets and wider distribution to snap up bargains

- Most will be lured by a decline in valuations, with a protracted downturn forecast to wipe off $76 billion of Unicorn market value, which currently stands at $510 billion for the sector's 58 fintech Unicorns

- The next segment to feel the pain and suffer declining investor interest would be early-stage companies (Series A and prior) that have yet to fully validate their business models

- Series B-D companies would fare better than their less-mature peers and could trade at par or even at a reasonable premium if they can demonstrate healthy growth, have unique IP and resilient business models

- Lending fintechs would suffer the biggest drop followed by capital markets. Insurance and payments would be less impacted. Business-to-consumer models such as those pursued by challenger banks will see valuations contract faster than B2B models

Access/Download the report by clicking this link or the image below

Note: All blogs posts till 2022 were migrated to this platform (react+next+tailwind). While all efforts were made to migrate wihtout any loss, the migration lost some images and broke a bunch of links in old posts. If you spot anything amiss, please notify me?