The Future of Financial Services? Invisible

Published on 5 Jul 2020 ⸱ 12 min read ⸱ 89 views

Introduction

In our daily lives, we make several financial decisions without even knowing they were financial in nature. Decisions like what groceries do I need today, should I take the car or bike or can I buy that expensive phone. All of the financial aspect happens in the background. But our decisions, driven by desire, impact our lives and our wallet. In my view, our financial system as well should be in the background, revealing itself at the point of need.

The financial system is the oil that keeps our economic machines running smoothly. Without it, we would not know how to pay for things (barter? what is the right value?), how to increase productivity (credit cards, home loan, business loan), how to keep our things secure (protection against damages to life, property, assets etc.) or how to grow our quality of life (how to invest for the future, which product?).

The Early Days

The early days of our financial system started with payments - we needed a better way to store and exchange value. Being an ambitious species, we needed to improve productivity - I can do more with 10 cows than with 2. Thus came credit - capital that you need to repay back with interest. We made more money than we had to repay back to the lender. This surplus money could either be reinvested to increase productivity or save for a rainy day. With that came investment products.

All of these financial transactions could not just be decentralised or left up to goodwill from either party. This required centralised "Trusted" financial institutions - Banks, Lenders, Mutual Funds, Insurance companies and so on. Further, to ensure that these institutions acted in consumer interest, regulations needed to be in place from central banks and regulators. Thus was born the large financial institutions we have today - the incumbent "Centers of Trust"

Our financial institutions needed to face the consumer - be there at all times, as a sign of long lasting trust. Trust easily translates between known people, and these "relationships" drove early adoption of financial products. It's no wonder that Life Insurance Corporation (LIC) of India has a market share of ~75% in the life insurance sector - majority of the insurance is sold within an agent's personal network. This model of distribution started developing cracks and needed reinvention

Digitisation - Fintech Wave 1.0 (Early 2000's-present)

The old way of distributing financial products soon became lethargic, opaque, inefficient and expensive. Technology offered financial services a new lease of life. I'd argue, banking was among the first industries to adopt technology. Startups in Fintech were founded on the sole premise of making financial products and services easier to understand, transparent in pricing and cost effective (for the business and the consumer). Not to mention, frictionless and instant to execute.

That is a very promising foundation to build on. Earlier banks were content with the organic user growth, building their riches by charging complex service fees for the smallest of services. Fintech's - startups making financial services easier and accessible through technology, completely changed the game of financial products and services. With consumer facing technology, Fintech's put the power of controlling their financial lives, back in the hands of consumers.

Obviously, there is that cycle of initial apprehension 🧐, niche product appeal 🤩 and mass adoption 🚀. Once consumers started seeing the power of a mobile app to control their bank balance, Fintech was unstoppable. Customers no longer had to visit or call a relationship manager to get their work done. Their work would now get done in seconds. Pricing was transparent and affordable. Technology allowed financial services and products to scale rapidly without costs scaling linearly. Fintech's meteoric growth got it the required eyeballs and it became mainstream.

Globally, startups have been garnering better reception and faster growth than banks. Look at the plethora of Fintechs globally - US has Robinhood (investments), SoFi (lending, investments), Affirm (Consumer Lending), Lemonade, Oscar (Insurance). Europe has Klarna (consumer lending), Monzo, N26 (banking), Revolut (payments). Brazil has NuBank (banking). India has PhonePe, Paytm (Payments), PolicyBazaar (Insurance), ZestMoney* (Consumer Lending). South East Asia has Omise, Dana, MoMo (Payments), Akulaku, Kredivo (Consumer Lending), Koinworks (SME Lending), PasarPolis (Insurance). The startups listed here are some of the globally better known ones. This is just the tip of the Fintech iceberg though. There are thousands such Fintech's with varying value propositions catering to the unique requirements of users in each geography.

Challenges - Fintech Wave 1.0

Existing Fintech models work great for distribution - not as great for building trust. Technology truly lowered the cost of distributing and servicing. Individuals that were earlier ignored and left out by the financial system are now increasingly included. These ignored people now have access to high yield, complex financial products and at the same (not higher) cost.

However, I'd argue that Fintech's are merely digitising existing/traditional financial products and services. There's a lack of true product innovation. This lack of innovation stems from a lack of data. Data on need, purpose, retention, churn and so on. When a fintech starts up, they don't have much to go with other than a traditional understanding of how the product works and what are the unit economics to play with to create a good/profitable business.

Further, Trust is tough to build digitally - when there is no existing, in person "relationship". It's no wonder that despite all the digitisation hullabaloo from Banks, their rate of digitisation is still below 20% of total. A 2019 report by Infosys Finacle (the company that provides Core Banking technology to global banks) and Efma, said that only 17% of 350+ responding banks claimed to deploy technology at scale. Banks have invested too much on their offline presence - agents, branch networks, channels etc.

Even new and existing Fintech's, with the large exception of those in payments, have reached a point of stagnation in user growth and increased churn or non-activity. I believe it's got to do with the 1st part of the cycle mentioned above - initial apprehension. This apprehension stems from lack of trust. A brand created with large amounts of capital thrown at user acquisition results in brand recall, not trust creation.

Embedded - Fintech Wave 2.0 (2020's - future)

In my view, trust centers are shifting, not necessarily away from banks but not increasing in them either. The value of trust is dramatically increasing in large consumer-facing startups. Companies like Google, Apple, Facebook, Amazon, Netflix, Zomato, Flipkart, DeliveryHero, Spotify, Gojek, Grab, Lazada and many more.

None of these startups are financial in any way - as in their core business is not to provide financial products and services. But users will still trust these startups with their financial data even more than banks. Add to the fact that these startups also have tons of existing data on their consumer base. This data can be leveraged to truly innovate the financial products that can be designed - specific to their core product and consumer requirements.

Banks no longer need to be consumer facing, they need be in the back end - providing the balance sheet and doing compliance reporting. Same with Fintech's. Fintech's have done the most important job of all, digitising the banking backend to make it frictionless and cost effective at the front end. Fintech's as well don't do too well with building trust.

Further, consumers don't wake up and decide to take a loan or insurance product or buy that stock for the long term. These financial products are not top of mind for consumers and neither do they open their bank's app to constantly check these things. Bank's apps need not be measured by DAU and MAU. These numbers should be low, in fact, if these numbers are high, it tells me that something is wrong.

Use Cases

Financial services and products would be much better adopted when embedded with an existing non-financial product or service. I think about buying a stock when I read a news article about it - why not buy that stock at the point of reading about it. I think about taking a loan when I am looking for a Phone on Amazon - why not take a loan at checkout. My tax filings are the dumbest thing - I have to manually enter all information.

Sure, a lot of this has already started happening and that actually helps my point. Solaris Bank, a German Banking-as-a-service startup, has its own universal banking license but its customers are other Consumer Facing brands that want to embed banking products. Zomato, an Indian food ordering platform has started an insurance product for on-time deliveries. Stripe, an American payments company, allows brands to seamlessly accept payments. Payments are non-core to most industries, yet all need it. Seyna, a French insurance company, has its own insurance carrier license but its customers are other brands who customise products depending on their specific use cases. In fact, Europe and other western countries have a Managing General Agent (MGA) License that allows the license holder to do all functions of a normal insurance carrier except carry the actual risk - that balance sheet is managed at the back end by the licensed insurance carrier.

Financial services can also be embedded in devices - not just on my phone. While searching for something to watch on my TV, I need to go through a separate workflow to subscribe to the OTT platform where my movie is streaming - why not complete it on the TV itself. Why not automatically buy a dental insurance plan based on my smart toothbrush usage? Subscribe myself to an accident insurance only for the duration of me using an e-Scooter - I don't want a blanket cover, for times when I'm safe and sound at home/office.

Was surprised when I read, in a survey conducted by US's FDIC, that 25.2% of the users accessed or used financial products/services outside the banking system. I genuinely feel that number is much higher. Anthemis, a European Fintech focused venture fund, in its report on Embedded Finance has detailed out how embedded finance will be in industries of Health and Wellness, Education, Media, Agriculture, Mobility, Energy, Construction and Real Estate, Urban Planning and Logistics and Trade. Credit Saison, in its post too, has highlighted the various ways in which industries can embed financial products. Highly recommended reading if you're interested in the future of Fintech.

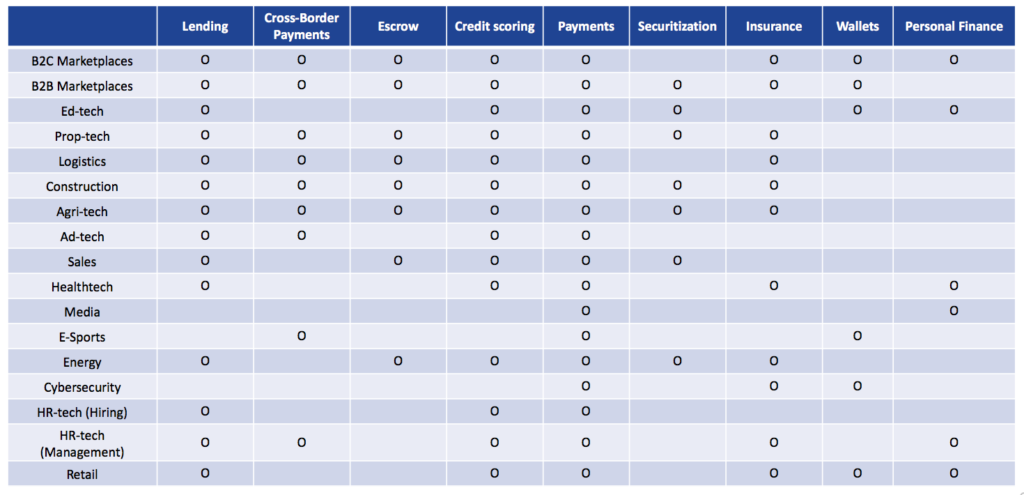

Various financial products that can be embedded across industries. Credit: Credit Saison

Challenges or Unintended Effects

Now, I'm not saying that all fintech in the future will be B2B or not consumer-facing. I'm saying there is greater advantage - for all parties involved when that happens. But this Embedded model, could also lead to a concentration - the Grand Rebundling. Few fintech startups could corner a majority of the market and will leave no place for new startups and innovation. This could result in higher cost for end users.

Secondly, how do you transfer the cost of risk in these cases. Most brands with non-core financial services offerings would not want to bear these costs. In this case, the product/service does not become truly embedded/bundled. We will need better ways to ensure risk is accounted for and the user experience is unhindered.

Third, how does each platform ensure data privacy and security of its user base? If the Fintech has to access user data to design unique products, how will that happen in the future where strict data protection laws will be in place.

At the same time, valuation is supposedly much higher when the startup owns the customer (B2C model vs. B2B model). Owning the customer means, having proprietary data on the customer. If Fintech's in embedded finance don't own the customer, will valuation appreciate appropriately?

Honestly, I don't have the answers to any of the above. Will be keenly looking at such models to arrive at an inference.

Conclusion - "Fintech Inside"

Financial services and products, not the financial institution, should be at the consumers point of need. The value of Trust is shifting away from banks to consumer tech platforms where true product innovation can happen. Technology allows a platform to scale its financial offering to the last customer that will adopt it. The future of finance is in making it invisible to the user, but, without it, everything crumbles. All industries will end up being "fintech-enabled", not just "tech-enabled".

Fintech Inside. Excuse the terrible photoshop attempt.

Ever since I started covering Fintech back in 2014, I've felt banks and financial institutions needed to be in the background. Today, technology and business model advances have made it possible to bundle financial products with non financial ones. I'm excited about how this translates in the future.

Anthemis in its report succinctly concludes, "The evolution of each of these components, and the interactions among them, will reveal even more adjacencies between financial services and virtually every other industry. We are at a key inflection point in which fundamentally new business models will arise and flourish. These new models will both unlock and create enormous value within and among our economies and societies and, along the way, create many new and successful businesses"

If you're building in Fintech, I'd like to speak to you and learn more. I'm keen to learn your views on Fintech, its future and its intersection with other industries. Please reach out at [email protected] or here

Onward.

Note: All blogs posts till 2022 were migrated to this platform (react+next+tailwind). While all efforts were made to migrate wihtout any loss, the migration lost some images and broke a bunch of links in old posts. If you spot anything amiss, please notify me?