Framework for evaluating investment opportunities in various countries

Published on 17 May 2020 ⸱ 6 min read ⸱ 43 views

Recently I've been mandated to evaluate opportunities in South East Asia, Europe and North America. For over seven years now, I've been evaluating opportunities solely in India - with the one off opportunity in US or Singapore.

The opportunity to evaluate investment opportunities on the global stage got me really excited. With it, came the aspect of starting from scratch - where do I begin, what are the sectors, which countries have the most potential for growth in the next 5 to 10 years and so on.

The blank slate, without any direction really got me going. I love it when people tell me the end goal but leave it to me to figure the direction.

I began with reaching out to my network of VC's and reading about startups in those regions. VC's because I wanted to learn from their experiences of investing in those regions and founders because I wanted to know how they think and build.

I must make a note here of how open and sharp the VC community is in South East Asia. Open - because they were very welcoming, explained their thesis, took me through their experiences and so on. Sharp - because they're SO smart and to the point. They lucidly explained complex concepts.

Through all of those conversations, I've learned a LOT! And for reasons unknown, I seem to always compare those learnings with what I've learned from investing in India. For example, the FMCG supply chains in South East Asia is similar to India, the payments network in South East Asia is still far behind India, the startup ecosystem in Indonesia is 2-3 years behind India in terms of maturity and so on.

With all of those learnings I've come to realise that countries in South East Asia are a few years behind India in terms of tech maturity and adoption. Similar can be said about European countries. But more importantly, I learned there's a way to condense all of that learning in a simple concept or framework.

Efficiency-Convenience Framework

The Efficiency-Convenience Framework is simply a method for me to categorise the various industries in a country. This categorisation helps me to evaluate a sector for its potential to create value in the future. For example is payments efficient in Indonesia? If yes, is it convenient? If not efficient, the opportunity is to invest in solutions that make payments efficient.

A visualisation of the Efficiency-Convenience Framework. Where would you place Ecommerce?

For your respective country, in the image above where would you place "Credit Cards"? What about "Logistics" or "Ecommerce"? And "OTT Platforms"? "Game Streaming"? "Payments"? Think about it, all of these sectors are solving for Efficiency or Convenience. And hence each of these sectors have achieved different levels of maturity with varying levels of opportunity.

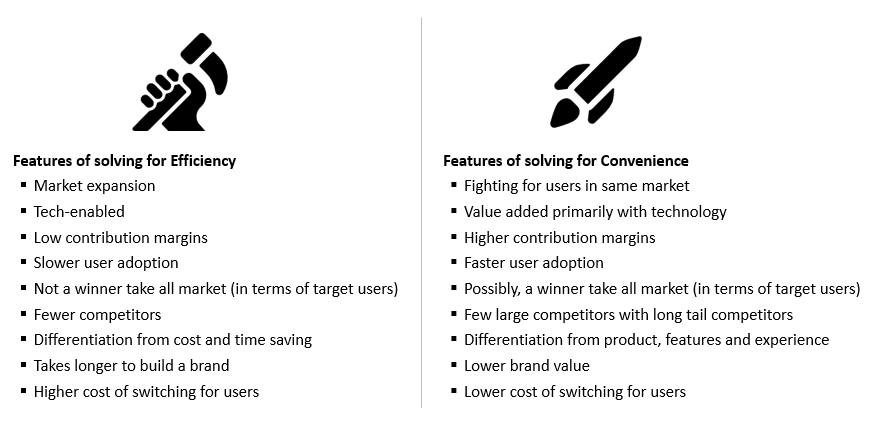

Now, sectors looking to solve for either Efficiency or Convenience have their own features. While I don't mean to generalise, it's uncanny how similar startups are when solving for Efficiency or Convenience. These features have their own pros and cons. Knowing where a startup falls in the Efficiency-Convenience Framework helps me evaluate a startup accordingly.

Features of startups solving for Efficiency and Convenience

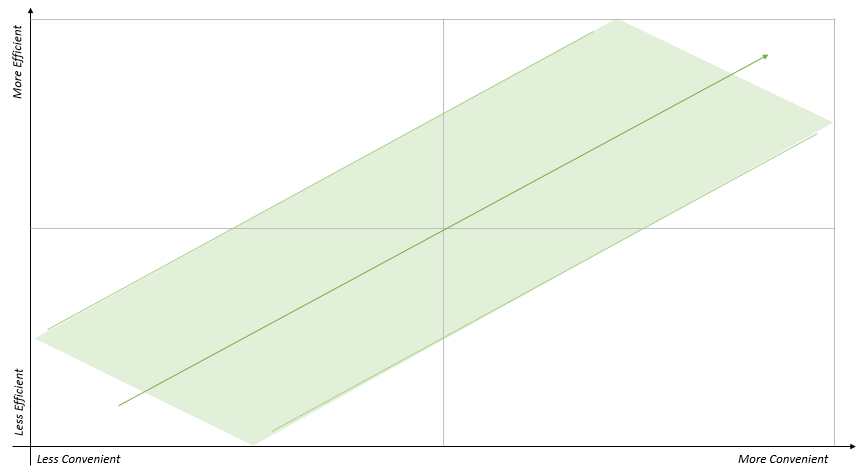

Within a certain country, various sectors have varying levels of maturity. These sectors either have the potential to become more efficient or more convenient. The sector will first start solving for efficiency and gradually, as the sector sees mass adoption, it solves for convenience. You'd effectively want to see a sector evolving as below: "Less Efficient-Less Convenient" to "More Efficient-More Convenient". Now, obviously, the reality of it will see a sector go from "Less Efficient-Less Convenient" to "More Efficient-Less Convenient" and then to "More Efficient-More Convenient". Very unlikely that a sector will go to "Less Efficient-More Convenient" - that would be odd.

Typical trajectory of a sector should be "Less Efficient-Less Convenient" to "More Efficient-More Convenient"

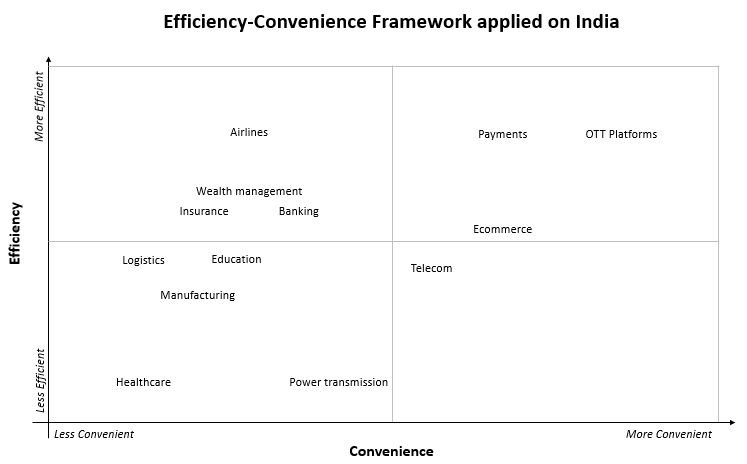

All this probably sounds great as a concept. So I thought of applying this framework to Indian sectors. India is a country I'd say I have a decent understanding of. Interestingly, the sectors when mapped on the framework seem to follow what I just talked about. Think about the brands you know of in these various sectors and correlate them with the features mentioned above. For Example, the Ecommerce sector: we have large brands Flipkart and Amazon and a long tail of Ecommerce players, the experience is fairly convenient and efficient, they're all fighting for the same wallet share and so on. They broadly fit in the framework.

Efficiency-Convenience Framework when applied on India

Now, the mapping is completely my own subjective application, and you may disagree with the mapping. But if you were to move things around based on your judgement, I can be reasonably sure the mapping would look broadly similar.

From the little I know about other countries, this framework broadly applies there too. And I look to applying this framework as I learn more about sectors in countries of South East Asia, Europe and North America. The end goal of all this is obviously to look for and make investments using this framework.

Now, I'm not saying that once mapped, the sectors will be static in nature. It's going to be constantly fluid moving from Efficient to Convenient and back to Efficient. Regulation or other "acts of god" may just accelerate or decelerate this process. It's all about constantly taking in the signals and applying it to this framework.

The "Efficiency-Convenience Framework" is just a name I'm giving it. I'm definitely not the first person to conceptualise this framework. This is also something that can be considered as common knowledge and something that's all too intuitive. I take no credit for this, simply jotting down my thoughts on condensing large amounts of information, my approach to using it and why it's helpful to me when thinking about investing in different countries.

You can download a slide to try mapping sectors yourself, if you want to. I encourage you to try mapping the sectors in the framework.

What do you think about this framework? Does it make sense to you? What do you think as hogwash in this? Are there other frameworks you've referred to reliably? I genuinely look to hear from you.

Onward.

Note: All blogs posts till 2022 were migrated to this platform (react+next+tailwind). While all efforts were made to migrate wihtout any loss, the migration lost some images and broke a bunch of links in old posts. If you spot anything amiss, please notify me?