Launching Eliza, my AI Venture Associate

Every month, I evaluate hundreds of inbound pitches from founders seeking capital. Like most investors operating at scale, I face an impossible math problem: the number of opportunities far exceeds the hours available to meaningfully engage with each one.

The existing alternatives are all broken. Email threads disappear into the void. Generic submission forms feel impersonal and often go unanswered for weeks. Founders spend hours crafting the perfect cold email, only to hear nothing back. Often I miss promising deals buried in the noise.

So I built something different: an AI Venture Associate that conducts first-call screening conversations with founders on my behalf. This is an experiment.

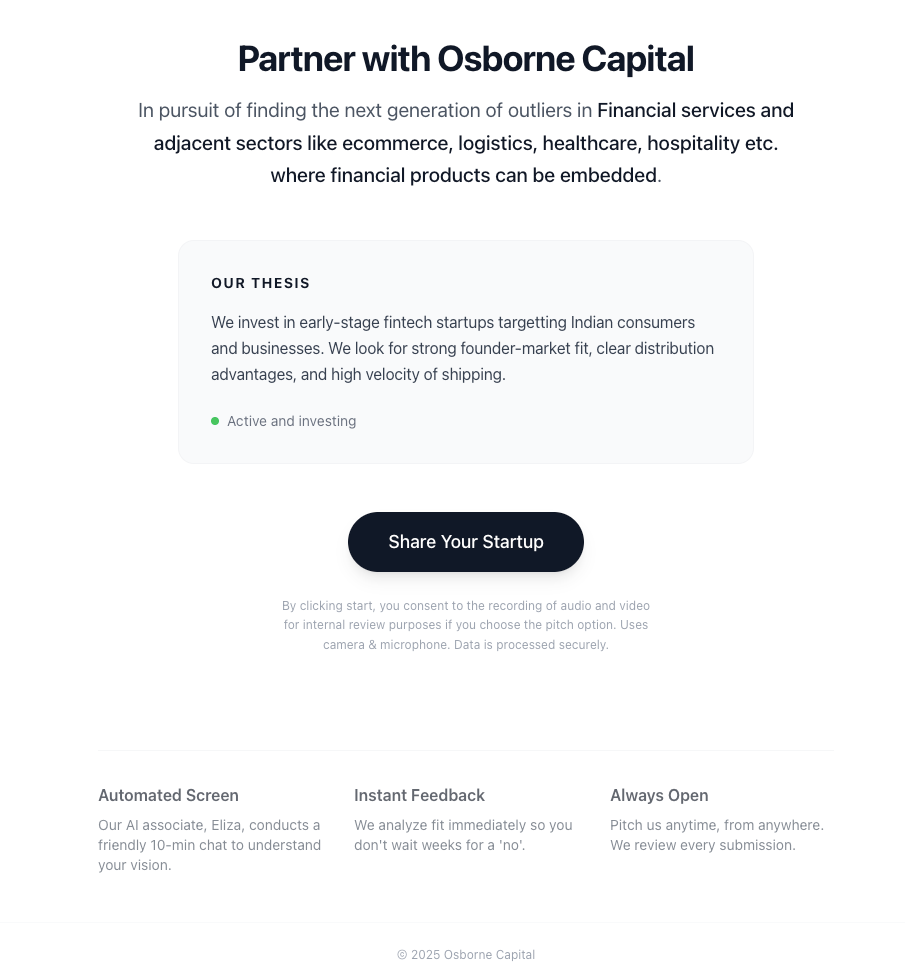

Try it out

How It Works

When a founder reaches out, instead of sending them to a static form or adding them to an endless email queue, I share a link to have a conversation with Eliza, my AI Associate.

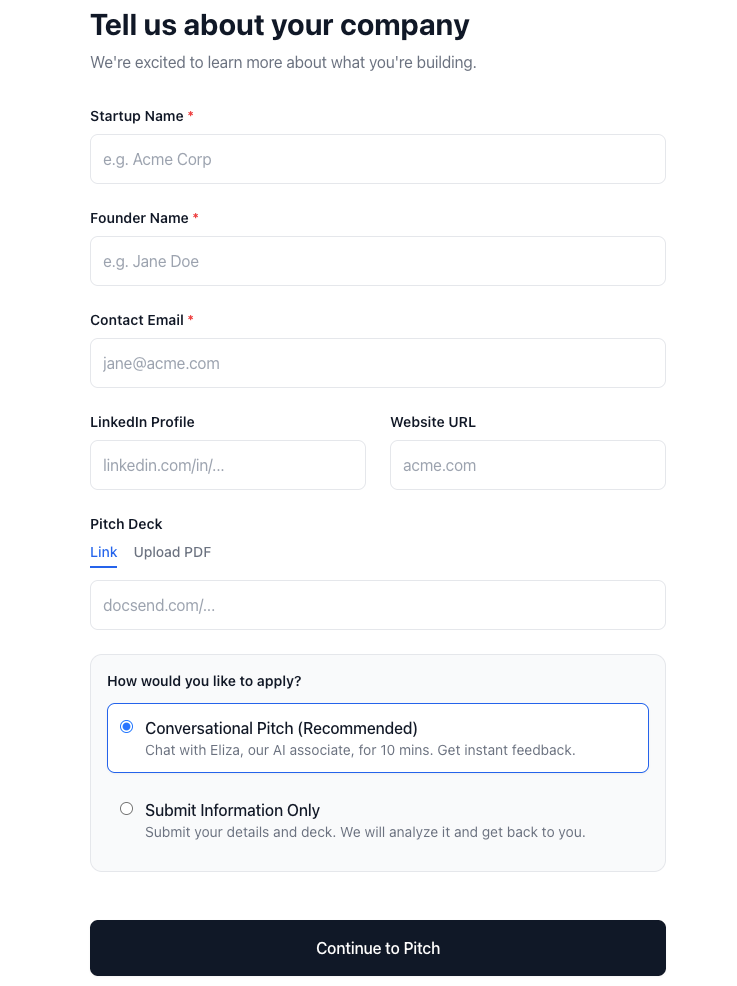

The founder can submit their pitch details as regular, but then they also have the option to pitch to Eliza immediately.

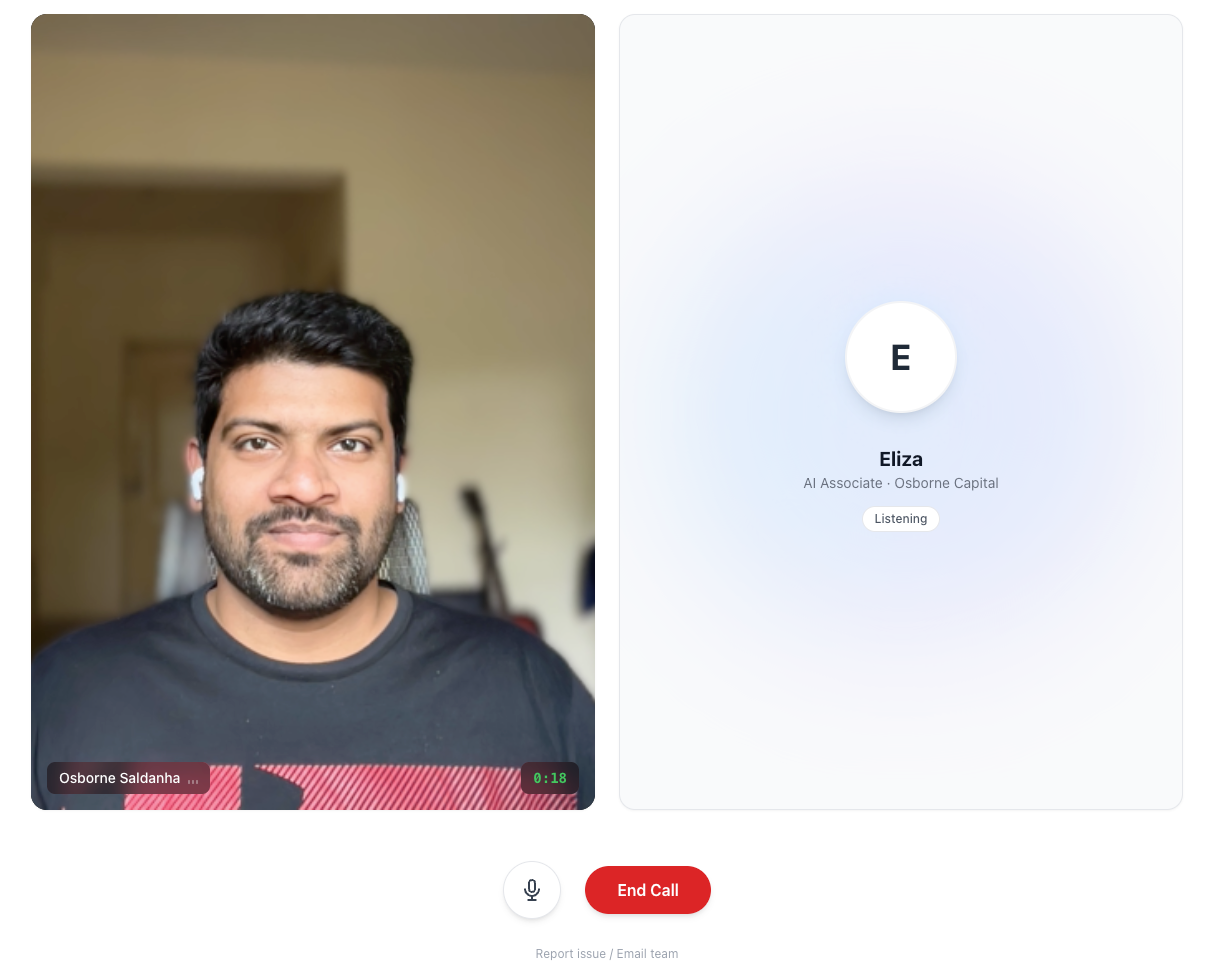

With Eliza, it’s a natural dialogue. The AI Associate asks the questions I would ask in an initial call: What problem are you solving? Who’s on your team? What’s your traction? How are you thinking about go-to-market?

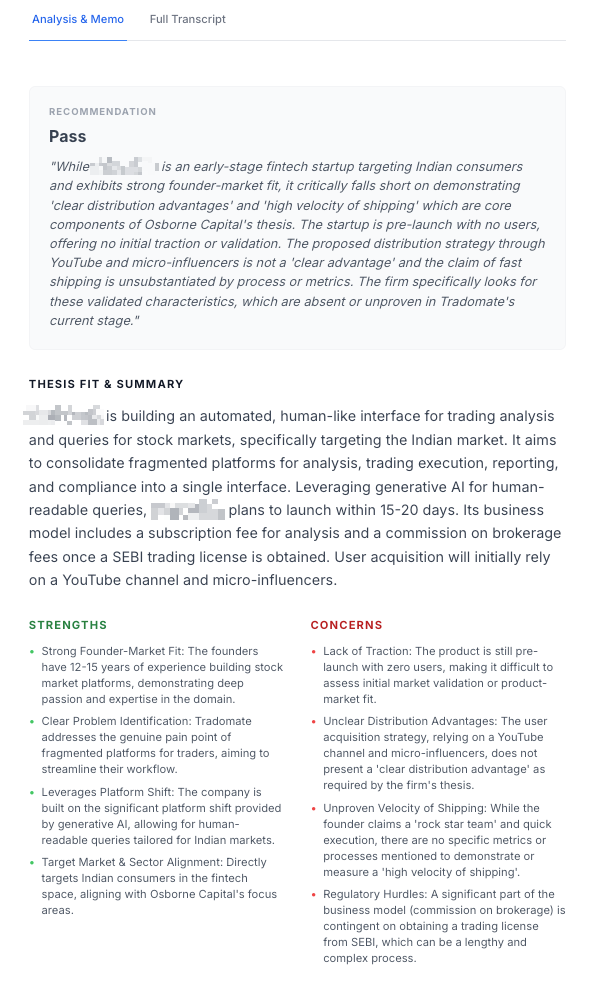

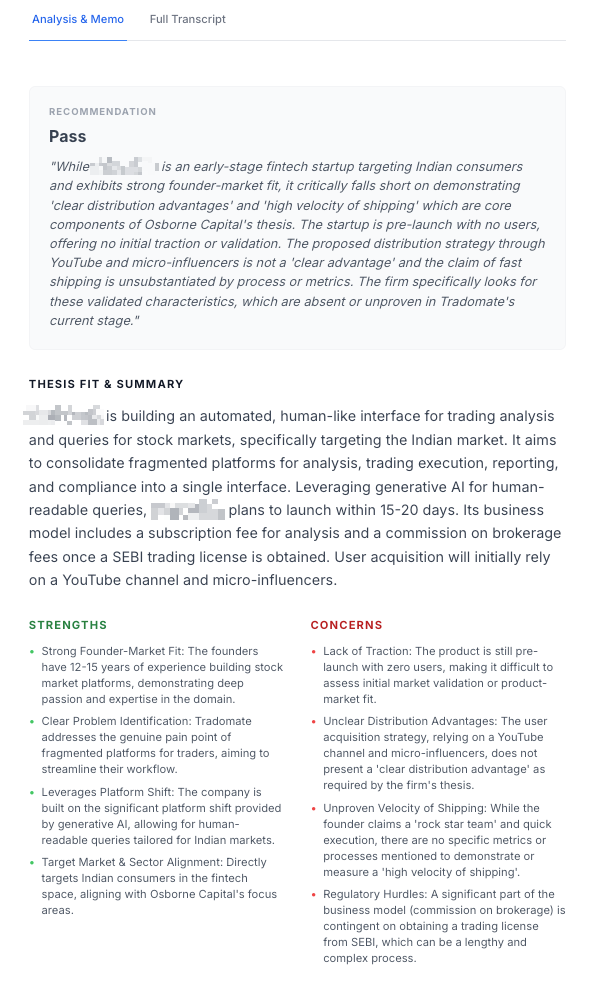

The conversation takes 5-7 minutes. At the end, I get a structured analysis and a preliminary recommendation on whether this opportunity aligns with my investment thesis. Currently, as its in experimentation stage, I’ve opened up the final analysis to the founder as well.

The system is buitlt to also deal with edge cases, including silence, not answering the question directly, abuses or unacceptable language and many more. I’m sure i’ll need to fine tune this edge case aspect, as people start using the tool.

From my (funds) perspective, I’ve added some fields to tweak/fine tune the AI Associate so that it uses my typical way of speaking. I also have the tools to listen to the audio of the whole conversation along with transcripts. I’m sure I’ll need to audit a lot of the conversations.

In my limited testing, I’ve been amazed (almost shocked) at how well the tool navigates asking questions, repeating questions if founder forgot it, doubling down on vague/high level responses, and much more. You must try it out to believe it.

The Clear Benefits

There’s no doubting that founders get instant engagement instead of email silence. A (real) conversation, not filling out tedious fields. Immediate feedback on how their pitch lands, with no calendar coordination for an exploratory chat. And honestly, more equal access. Your idea gets heard regardless of your network.

On my end, I can hopefully evaluate far more opportunities without burning out. The evaluation criteria stays consistent across all pitches. I free up time for deeper conversations with high-potential founders and get better across the entire pipeline. Plus, no more guilt about the “nos” sitting unanswered in my inbox.

The Uncomfortable Truth

But here’s where I need to be honest about the limitations and concerns.

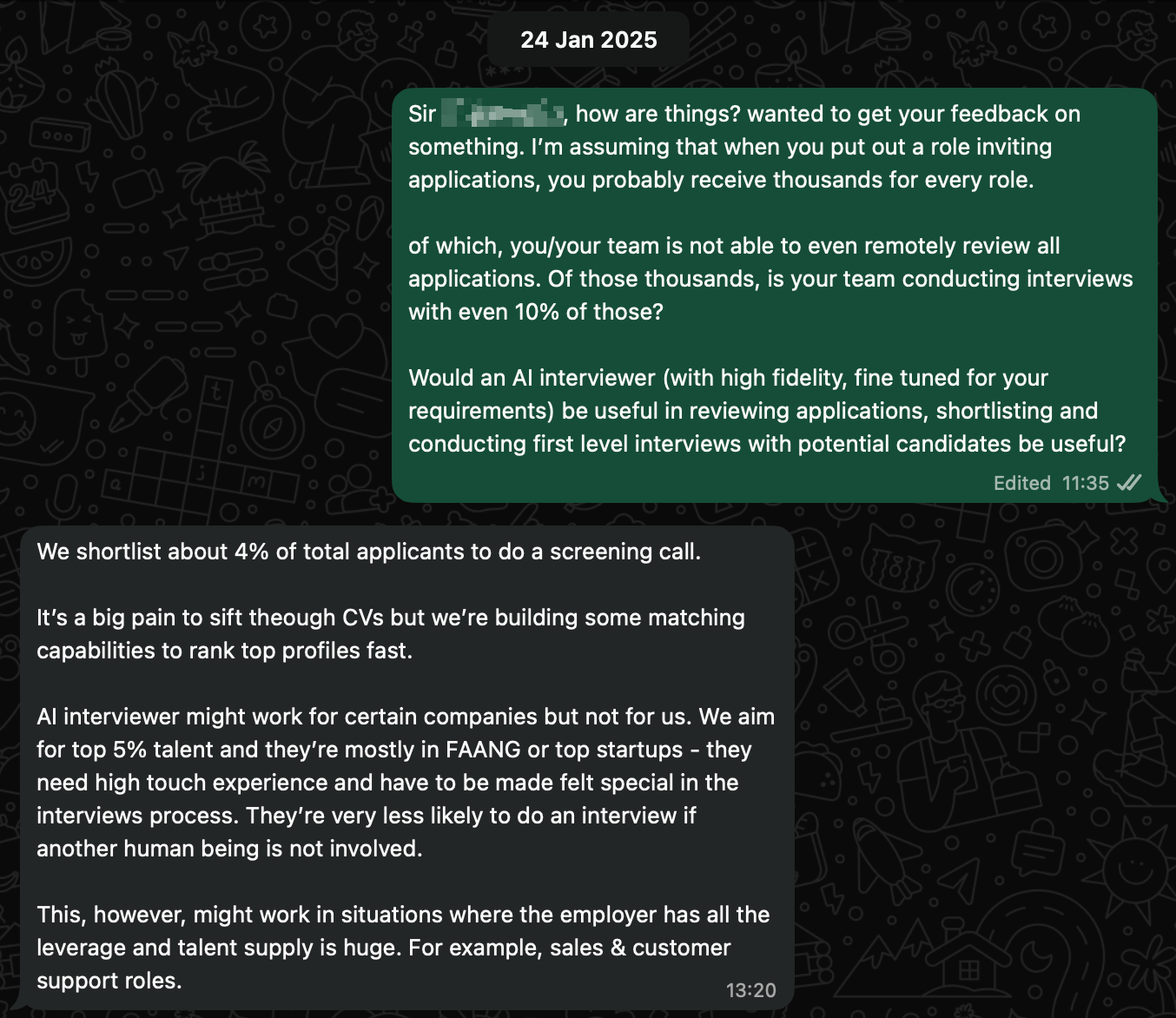

Here’s the dichotomy: Early 2025, I reached out to my friend for a random brainwave I was having regarding AI interviewers. He was and is spot on. If I’m targetting the top 5% founder talent, that talent will be thrown off if the interviewer is not a human. The top 5% talent needs to be made to feel special. I’m being super mindful of this.

This isn’t a replacement for my/human judgment. It’s a filter. Venture capital is fundamentally a relationship business. Chemistry matters. The intangibles that make you believe in a founder (their resilience, their ability to pivot, the glint in their eye when they talk about their vision) don’t compress into an AI summary.

Some founders will hate it - I’m well aware of this. And they’re not wrong to. Getting funded is deeply personal. Pouring your vision into a conversation with an AI agent, knowing a machine is making the first cut on your life’s work, can feel dehumanizing. For founders who’ve been building relationships in the ecosystem, this might feel like a step backward.

Pattern matching can perpetuate bias. If the AI learns from historical “successful” investments, it risks reinforcing existing patterns rather than identifying contrarian bets. The outliers (the deals that don’t fit the mold but change industries) might get filtered out.

Context gets lost in a 5-7-minute conversation. The founder who’s pivoting from a failed attempt and demonstrating real resilience. The technical innovation that’s hard to explain quickly. The market timing that requires deep sector knowledge. Nuance gets compressed.

And there’s distance created here. Even if it saves time, there’s something valuable about an investor personally reading every cold email. It keeps you connected to what founders are building, to emerging themes, to the pulse of innovation. Delegation, even to AI, creates separation.

Where We Go From Here

I’m using this tool, but I’m also watching carefully. The only metric that matters isn’t how many pitches I can process. It’s whether I’m finding and backing the right founders. If I start missing great deals because they didn’t perform well in an AI screening, that’s a failure of the tool, not the founder.

My current approach: the AI is a first filter, not a gatekeeper. Founders can always reach me directly. The agent explicitly tells founders they can request a human review. And I randomly sample conversations to check for false negatives.

The promise of AI in venture isn’t replacing human judgment. It’s removing the administrative friction that prevents investors from spending time where it matters: in deep, nuanced conversations with exceptional founders.

But we need to be honest about the trade-offs. Speed and scale are valuable. So is serendipity, intuition, and the human connection that makes someone believe in you enough to write a check.

The best outcome? This tool helps me find more great founders to have real conversations with. The worst? It becomes a wall between me and the next generation of builders.

I’m betting on the former. But staying vigilant for the latter.

What do you think? If you’re a founder, would you pitch to an AI agent? If you’re an investor, where do you draw the line on automation in deal flow? I’m genuinely curious, and the irony isn’t lost on me that I’m hoping for human responses to this post about AI.

Onward.

Note: screenshots are of a dummy company I made up during testing. It doesn’t show any real startup data.