A Decade in VC

Published on 14 Jan 2024 ⸱ 28 min read ⸱ 117 views

I started as an Analyst at Tuscan Ventures on 13th June, 2013. Ten years later, I'm more ambitious and hungrier than ever before.

It's almost as if we're in a different world a decade later, yet things are so much the same.

Writing this as I reflect on my career so far - things I did, things I could have done better, some rules of being exceptional and what I want for my career over the next few decades.

The famous Bill Gates quote "most people overestimate what they can do in one year and underestimate what they can do in 10 years" couldn't be truer for my past decade in VC. It's more so true for India's progress.

Me - 2013 to 2023

When I started as an analyst in 2013, I really didn't know what I was getting into. All I knew is that I wanted to become an entrepreneur and solve problems for people. I didn't really know what VC was. But I will never forget that in 2010 or so, my plan for my life was to be a serial entrepreneur - solving one problem to another. Back then I had it all figured out, I planned, "I'm about to turn 20, would probably live till 80, so I can work till I'm 70 and then chill till I pass. That would give me roughly 50 years of active work. So I will start a company, grow it for 10 years, "exit it" and on to the next. Repeat five times and that would be a life well lived". Naive little me. That I had plans when I was 14 to build the world's first humanoid robot, is a story for another day! 😆

I say "exit it" in quotes because I really didn't know what it meant back then. Heck, I didn't know anything about finance, I am an IT engineer (computer science) by education. I love coding. I'm one of the few folks (at least in my college) that got into engineering because I really loved it. My parents did a lot to get me into engineering college. Only recently I've been realising how deep of an impact my parent's work ethic has had my work ethic. Anyway, I digress, point was that I didn't know a lot about finance or starting a company. I still don't know a lot about those two topics and probably never will know it entirely, but I've come a long way and have become a life long student of finance and business history.

Come to think of it, given all this context, I could never, NEVER have planned to get into VC, let alone become a VC investing in financial services of all things!

Today, I believe my life's vocation is to be an investor. I don't see myself doing anything other than partnering with founders and helping them achieve their dreams.

I didn't know it at the time, but my first job was effectively my MBA. My growth trajectory was super steep back then. I learned how to use excel, how to read an legal agreement, how to negotiate, how to analyse a market, how to evaluate a startup and so many other things. My bosses and colleagues Shagun, Sameer and Dhaval had some serious patience in dealing with me. At that time I had a kind of arrogance that I knew everything, and they made sure to show me that I didn't, in a good way. It wasn't the easiest to deal with at the time, but I know now and appreciate it so dearly. I was fortunate to also be entrusted with $1mm to manage - something I don't think I would have gotten anywhere else. I didn't work long enough to realise gains, but showed a healthy ~2.4x TVPI. I remain grateful to that team.

I was also grateful for the opportunity to work in the investments team at Xiaomi. At Xiaomi I learned how to get comfortable with limited data while making decisions. The team there was exceptional. I got to meet and learn from some exceptional folks, including Shou Zi Chew who is now the CEO of Bytedance. The learning curve was very steep - learning how to work with colleagues who don't understand the language, nuances of a region etc. and yet help them build conviction in a potential investment. I quickly learned that corporate VC was not for me though. Moreover, covid forced Xiaomi to change its investment strategy which didn't align with my future goals, so I moved on.

While at Xiaomi, in Oct 2020, I decided to publish Fintech Inside, a weekly newsletter on the fintech ecosystem. This newsletter single-handedly changed the entire course of life - personally and professionally. I don't think any other project of mine has had a bigger impact on me. Let me elaborate.

Around the same time (2021), I joined Emphasis Ventures and that has been a roller coaster ever since. Early stage investing is just so exciting - we did 10+ new investments, 10+ portfolio investments, a couple of exits and were fortunate to partner and work with some exceptional founders. There's so much more to do with Emphasis Ventures.

Since launching the newsletter, I've met some of the most influential people in financial services and venture capital. That access has helped me improve my craft of investing manifold. I've learned so much more about investing in just the past three years, than in my entire career prior to the newsletter. I'm a lot more cognizant of the attributes, in my assessment, required to become the greatest. The newsletter also got me more inbound job offers than I could ever ask for, even when I wasn't looking for a job. I could go on about the benefits - personal and professional, I've had from the writing in public. When I said my previous work experiences had a steep learning curve, I had no clue how steep this learning curve would be. Launching the newsletter feels like taking a shortcut to success. I'm so incredibly lucky for it.

As you would have realised, I've worked at a family office, a corporate VC and a fund all while learning investing across stages (pre-seed to growth). There's so much more to my work experience that it feels like no giving due to it, but I shall leave it at this for now. My experiences have helped me identify my strengths, shortcomings, skills, things I like doing, things I don't and so much more. Knowing what I know now, my bar for excellence is significantly higher and my bar for ambition even more.

India - 2013 to 2023

This country of India has grown leaps and bounds this past decade as well. I'm juxtaposing India and myself as I believe we've seen similar trajectories. I've long held the belief that a "country progresses despite it's government and because of the growing ambition of its people". Today I realise there are nuances to it and good governance can meaningfully influence a country's growth trajectory, but I still largely believe my view holds water. This section is not to make a political statement or talk good/bad about a political party/parties. I'm referring to our country of India and the progress we as citizen's are making.

India looked dramatically different in 2013. No one could ever anticipate UPI, Covid, Jio+Xiaomi, GST and many other mutually exclusive, completely random events converging on a timeline to create the perfect cocktail for India's meteoric rise.

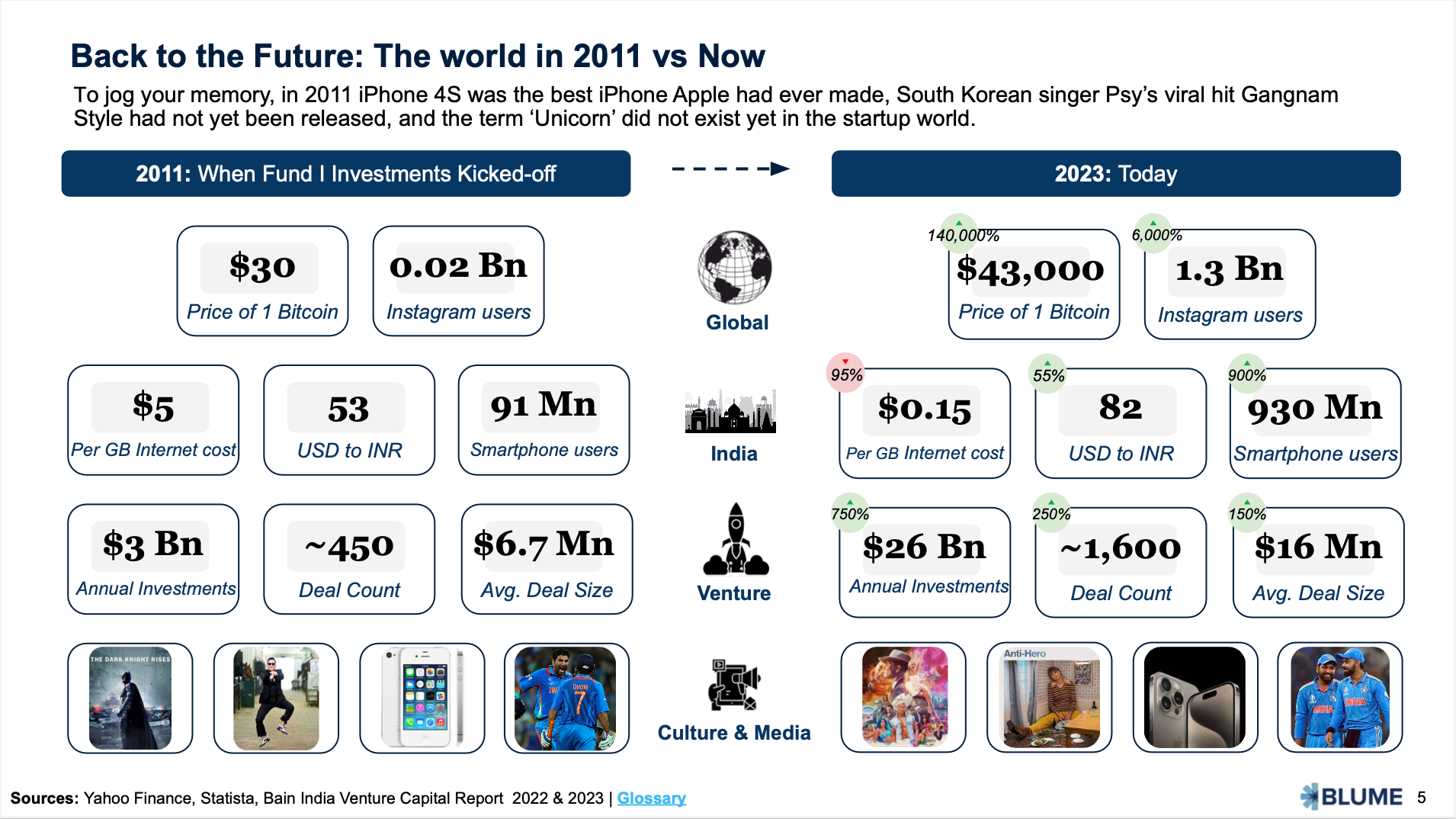

I was going to pull up a whole bunch of stats comparing India in 2013 and 2023, but our friends at Blume made my life easier. Here's a screenshot from their incredible Omega Files.

Rules of Operating

I've never really been an active person. I'm the laziest person I know. I blame intertia! The most sports I've played was when I represented my school for table tennis. My dad was footballer, playing up to state level until an injury made him focus on other priorities. As I grew up and earned my own money I wanted to try sports and new activities - so I signed up for kickboxing, the most extreme thing I could think of.

With the right coach, kickboxing taught me a lot about life and entrepreneurship but most importantly it taught me that the right form is crucial to a good practice and a good practice is crucial to being great. Without the right form, even 10,000 hours of practice will not help you win. With the right form, you'll realise where your center of gravity is. With the right form, you'll keep your hands on your jawline (to protect your face), even when you're attempting a round house kick. Even a slight variation in your foot movement when you're packing a punch is critical to getting the right powerful punch. Practice with the wrong form for your foot movement and at maximum you will graze your opponents face but at minimum you will suffer an injury (long term or short depends on your fitness level).

Point of this is that, in investing, one needs to constantly improve their form, a good foundation of systems and processes to operate. Then be disciplined and consistent by practicing with that great form. If you start your career with mediocre form, you'll compound mediocrity and eventually it'll become tough to be exceptional at your work. To make sure I continue to develop and improve my form I wrote down my rules of operating.

This section is mainly a ready reckoner for myself. It's pointers and rules I've come up with for myself for how I wish to operate as an investor in startups and partner to founders. These are rules for my version of what an exceptional investor looks like. These "rules" can very easily be applied by anyone else who wishes to be an investor. A lot of this takes discipline but more importantly takes consistency. I'm far from disciplined ever further from being consistent but I show up everyday, hoping to be disciplined and consistent and improve just that little bit every day.

A lot of these rules are interconnected as you'll come to find out but I wanted to write them out separately. There's a lot of nuance to these rules and I've tried covering that nuance without being too verbose, but each of these rules could be entire posts. I know these are more than a handful, but being exceptional is not easy, otherwise everyone would be. I felt these rules needed to be mentioned separately. It's obvious, but I guess I should mention that I'm not exceptional in any way. I'm hoping I achieve it someday. Sooner will be better :D. Also, except for the first rule, everything else is in no particular order.

Rules to be exceptional

-

Be an insight seeker: I'm convinced that beyond a certain point, insight seeking is what sets apart the truly exceptional people from the crowd. What about hard working people? Farmers work harder and longer than most people we know, but most farmers are not exceptional/successful. What about smart people? A lot of people are smart but few are exceptional/successful. Everyone has ideas, but very few execute and make things a reality. Insight seekers are never satisfied with what they produce and how they produce it. Insight seekers are always on a journey, never reaching a destination. They're constantly seeking ways to find an edge over others that will make their output better. At least in venture investing, insight seeking comes in many shapes and sizes - insight seeking on market, consumer behaviour, competitors, senior execs, founder background and so much more. Insight seeking is about finding that edge, an edge to make you that much better than the next investor.

-

You are the average of five: If you want to be exceptional and successful, you need to surround yourself with exceptional and successful people. There are no two ways about this. The old adage of "You are the average of the people you spend most of your time with" is a cliche and true for a reason. Over the years I've come to realise how important this is and have unfortunately organically moved on from people I thought were good. It's a sacrifice I unknowingly made in my quest to be better everyday. There are very real benefits of surrounding myself with people better than me. Your colleagues, your significant other, your friends, your leaders - seek out the exceptional. It's the most humbling experience to be in the presence of excellence - you learn you're not that good and have a long way to go. Excellence begets excellence. This excellent interaction between Luca in the show The Bear hit it home for me and how.

-

Work on building relationships: To me, a social network is one where when new nodes are added the whole network benefits. The people you meet and the networks you build will be important as you progress in your career. You'll realise some people are incredibly kind and open up their networks for you. There are two important aspects of building a network though: 1. network (verb) without expectations; and 2. network (verb) to build relationships. It's important not to have expectations while building relationships - you can't always be pulling favours and having requests from people you meet. That's called being transactional. As you build these relationships, try to learn more about the person behind the title. I've realised the person/company's public view is really not a fair view when I meet the founders/leaders behind the public persona. Learn about their likes and dislikes, they'll remember you for a long time and the reasons why they remember you. That's a powerful network to build. I cherish the relationships I've been able to foster with some of the most kind and exceptional people.

-

Play long games with long term people: I've realised that our startup ecosystem is very insecure. Insecurity breeds lack of trust. It's very difficult to find secure people and more importantly trustworthy people who are long term players. That's not to say there's a dearth of secure, trustworthy, long term players. There are a lot. Show that you are trustworthy and a long term player like them and they will reciprocate. This game of investing is a long, win-win game. You need to survive long enough with people who think long term and who believe everyone can win (not make it a win-lose game, where others lose). This game is no fun going solo and without long term players.

-

Be hospitable to founders: In a world where capital is abundant, the service you offer to the founder becomes a key differentiator. And hospitality makes a hell of a lot of difference. As investors, we're in the people business. Some investors may believe that our customers are our LP's, but I believe our customers are founders - if the founders do well, our LP's do well and consequently we do well. VC is the only service industry that has not thought enough about customer satisfaction. All of this aside, in starting a company, a founder is taking on significant risk and is going through a lot of headwinds - team, product, family, shareholders, internal emotions, competition to name only a few. As an investor, at minimum I need to respect the founder's time and preparation in pitching me. Fortunately, the bar for a good service is very low. There's a lot more I can and should do as an investor to improve my product offering for founders.

-

Hold strong points of view but constantly seek to challenge them: All of investing is putting money in one's own view of the world and the future - Points of View Bets or Conviction Bets. So you have to keep listening to data signals and developing ideas and points of view about the world and the future. A lot of people have ideas and points of view, that's why different businesses get funded - each investor has their own interpretation of the future. That's also why, out of an exhaustive set of a few thousand stocks in any stock market, we have several thousands of mutual fund schemes (investment plans). However, different people have different views about challenging these points of view. I think you need to approach an investment opportunity with a strong POV in an idea/sector but you cannot afford to be rigid about the same. Tech, user behaviour, platforms, macro environment - everything is constantly evolving. If you're not seeking out data points or anecdotes to challenge your POV/ideas, you'll not have a long career in VC. It's super tough to have a malleable mind in VC but that's what makes it interesting and fun. The other aspect about this particular rule is that our business operates in cycles. Every 7-10 years we see similar business models making a come back, and maybe a business model's time has come. Unless you're open to challenging our own view points/ideas, you could miss out on a multi-bagger opportunity. At minimum, be sure what parts of your POV you want to be rigid about and what parts you're open to challenging - there's a lot of nuance to investing.

-

Pay attention to the details: I can't tell you the number of times I've messed up, personally and professionally, because I overlooked the details. Details matter. There are no two ways about this. The details of a legal document or diligence process, the evaluation process, the words I use in conversation, the process of evaluation, the language you use to describe your brand and your craft, the numbers - the details in all of these aspects matter. Again, if you make it a habit to overlook the details, this behaviour compounds and you'll grow to never know to look at the details, making you a mediocre executive. This aspect of "knowing to look at the details" is something you learn as a skill from someone who does it. Another reason why it's important to surround yourself with exceptional people. At the end of the day, people notice the details. Among many other little stories of the exceptional show The Bear, this particular interaction between Richie (I feel like a Richie in this scene) and Garrett about why it polishing the forks the right way matters to him.

-

Be curious. Assumption is the mother of all f**ckups: I know "Be Curious" as a rule sounds silly because humans are inherently curious creatures. The "don't assume anything" rule was drilled into my mind as a lesson with this video because I used to make a lot of assumptions early in my career. I almost always assumed things would work a certain way without questioning it because someone else said so. I wouldn't pursue my own curiosity. I would also very easily borrow other people's theses and conviction because I wasn't applying my own curiosity. I've only recently learned to force myself to pursue my own curiosity, ask "why" five times and get to the fundamental principles. Of course beyond a point you make your own calculated assumptions based on what's in your control because you'll have access to only so much data. Curiosity also leads you to identify new trends before most people which in turn becomes useful in early stage investing. More recently, I've had to let go of my assumption that there're no exceptional investors in the Indian ecosystem (yes, I've been very cocky) and pursue my curiosity to find and learn from investors who've made some multi-bagger returns. Hopefully this serves as an inspiration for me.

-

Learn to speed comprehend: IMO speed comprehension is a legit super power in this industry. As an investor, you spend copious amounts of time reading - reading MIS, update emails, industry reports, analyst reports, news, books, legal agreements and the list goes on. Not just skimming, but literally reading the entire thing and actually comprehending the entire text/report. I believe I suffer majorly in this aspect because I've never really developed this skill of speed reading and comprehension. I detested reading books - I'm a self-diagnosed visual learner. But when I see others finishing pages when I've barely finished the first paragraph, I realize what a handicap I have. Imagine the amount of reading and absorption they're able to do in a day, when I could probably only complete 15-20% of what they can do. At times, I've printed out text, as it's easier to read without distraction or even literally put my finger on the screen and moved it word by word because I've been told it helps improve reading speed. I feel this is still a work in progress for me and will continue being one.

-

Be a generalist but develop one superpower: In VC you have to be a generalist - generalist in skills, in operations and in theses. Because firm sizes tend to be so small, everyone ends up doing everything. You have no choice to say no. You'll end up reviewing legal agreements, doing site visits, reviewing financials, checking in on firm compliance, marketing/social media and many other things. You mostly learn all those things as you go. Even in terms of sector focus and stage focus, you can be a generalist and do all sectors that excite you. You have to learn to be good at it all. But you can't be a jack of all trades and master of none. If you want to be truly exceptional, you need to be the best in the industry/country/world at one thing. That needs to be your superpower. You need to find that one thing people will remember you for and no one should think of competing with you on this one superpower. Find it and make it your own.

-

Write more: As mentioned, I didn't like reading and so I also didn't like writing - it's too much work. I forced myself to write from the early days of my career - telling myself to write at least one post a month on any topic I thought of. Writing has helped me distil my thoughts and build conviction in my own curiosity and theses. The biggest gift writing has given me is having a first principles understanding of systems and processes. The other side effect of writing publicly is that people love pointing out when you're wrong. This leads to two outcomes: 1. you automatically seek out facts and anecdotes vs writing conjecture. You give adequate disclaimers and you ultimately know exactly what you know for sure and what you don't. 2. You learn. You learn a new perspective or something you never knew before. In both outcomes, you benefit. So write more.

-

Develop a bias for action: Bias for action increases your surface area for luck. A lot of people loves being armchair intellectuals. Very few actually do something about their views/ideas. Even fewer finish what they started. Don't just say and plan things, try to actually make it happen. Avoid trying to make the perfect plan. Just do. Perfection is enemy of progress. The more you do, the more you learn and they the more you become exceptional. IMO, doing is the best way to learn. Learning about things is not learning. They say "youth is wasted on the young" because as youth (early 20's), we're brimming with creative ideas and want to do so much to change the world. I was like that as well, I had some pretty wild ideas. But before I finished the first project, I found a shiny new idea/project and pursued that. I prioritised other things at a time where I didn't have as much responsibility as I have now. I still have some of those traits but I try to be mindful about focussing on the current project. I've also stopped planning to much, I build a broad overview and just get going. People that have a bias for action are really the exceptional ones - learn their ways and imbibe it in your process.

-

Dress for the part: This may sound frivolous, but we've obviously heard the quote "the first impression is the last impression". That saying is true for a reason. I've noticed only recently that people treat you based on what they see and perceive of you. If you're dressed well and look a certain way, people will make way for you in a narrow walkway, will open doors for you, will treat you well and do many other softer aspects differently. The way you dress can also show that you're a confident or trustworthy person - important characterises for an investor. This again is where the details matter. I doubt folks will take you seriously as an investor if you go to a board meeting with unkempt hair or crumpled clothes or in flip flops. You'll get by but you will not be exceptional. If you expect people to trust you with capital allocation, it's important to look the part. I'm not saying looks are all that matter or that you need to show up in Gucci or LV, but your looks are part of the non-verbal cues people unknowingly evaluate when they meet you. Dress well and dress for the part.

-

Be trustworthy: This sounds stupid and its funny that this should be rule, I know, but hear me out. Because a lot of our decision making happens behind closed doors or not in public, it becomes super easy to be loose with integrity or trust. Plausible deniability. Their word against yours. Moreso, because there are less than a handful of good early stage deals, everyone wants in and most folks don't trust easily. The bar to be trustworthy is so low in our insecure ecosystem except among exceptional people. It should be a given that you have high integrity and are a trustworthy person. You're managing capital after all. Trust takes a painstakingly long time to build. It's a journey, not a destination. But one error of judgement and you've lost it all forever. There are also several stakeholders that need to believe you're trustworthy: your team, your founders, your LP's, the ecosystem and many others. If they can't trust you, you will not get access to the best opportunities because long term people play long term games with long term people exclusively. Trust begets trust.

-

Don't ever be a hater. Just don't: This is another one that sounds stupid to have as a rule, but still needs to be said as the bar is so low. It's related to the rule about "being hospitable" but needs to be said separately. 1. Don't be a hater of founders. Among all of us that has a brainfart of an idea about a problem statement, if a person has decided to do something about and start a business, then in the minority of less than 1% of people. The rest of us are armchair intellectuals. You cannot and should not hate on such a person for attempting to move humanity forward. 2. Don't be a hater of another investor. Investing is taking risks. Sometimes risks work, sometimes they don't. An investor decides to invest their money in their view of the future/world. Sometimes the timing is not right. Today, it may be another investor who loses, tomorrow it could be me. You can avoid a lot of embarrassment by simply not being a hater. The downside of being a hater of everything is that you pull everyone around you down with you and it becomes an echo chamber. No prizes to be won here. Besides, what's the upside of being a hater? I'll end this rule with this excellent excellent quote from Kevin Scott, CTO of Microsoft: "There is no historical precedent where you get all of these beneficial things (technological innovations) by starting from pessimism first. Pessimism doesn't get you to optimistic outcomes."

-

Learn how to use analogies: Analogies are a shortcut to helping you build consensus. An idea never became a large business or outcome without you building a consensus with enough people. When we develop a theses/idea, we have to convince other people (consensus) to believe in our view of the future. Conveying our ideas the right way helps other people share our conviction in the investment opportunity, the team, the market and so on. There's no better vehicle to convey an idea than a banger analogy. I absolutely suck at using analogies in my these reports. My manner of speaking is more pedantic, almost scientific. I assume people are logical beings and so will understand pedantic logic. Except, we're also emotional beings. We need to relate to something for us to get it. We need to feel something for us to share your conviction. The best investors and entrepreneurs are great at including analogies in their talks and therefore great at storytelling (not fiction). That's why they're able to rally people and work toward their version of the future. The truly exceptional capital allocators are always using analogies.

-

Learn to help yourself before you ask others for help: Avoid asking for introductions, if you haven't exhausted other options. Avoid asking "who should I meet?" without making your own list of people to meet. Avoid asking "what's the market size?" without doing your own homework. Avoid asking "how do I find this data?" without at minimum googling it yourself. Avoid asking "what should I do next" without thinking of next steps yourself. Avoid all this. Try before you ask. There's no harm in asking, but nobody will help you without you showing that you've tried helping yourself first. In my experience, the truly exceptional are extremely kind and even more helpful to those who try things themselves. If you try to get things done yourself, after repeatedly trying and failing, you end up figure out how things work and get things done yourself. There's no better satisfaction than that. Help yourself!

-

Be proud to put your name on your output: The thing about putting your name on a piece of work is that you end up caring about the output a lot more. If it's your name on the line, you care if all text is of the same font type and size, you care if the images are displaying properly, you care if the data is cited correctly, you care if the text boxes are aligned well. The finer details start to matter. Most people do this out of fear, but once you start feeling pride in your work, signing off with your name, the quality of output dramatically improves. I obsess over these things when I'm creating a piece of work. It's important to me, even if nobody sees the details. It's not been this way for me in my early years, where I would output some pretty horrendous work. My colleagues corrected me and now I'd rather not submit something if I'm not proud of putting my name on it. That's how I look at everything I do. When you work in a team, more often than not, other people (especially seniors) viewing your work may have an entirely different way of presenting things and that's where the nuance lies. Early in your career, you need to output work that appeals to them. But later on, you get to choose what you believe is the your best version of that work. This is why it's important to work with exceptional people, because they show you the details that made them exceptional.

My singular focus and goals for the next decade

For this next decade, I'm even more ambitious than I've ever been. I don't think I could live in a better timeline in history. There's so much opportunity, hunger and risk taking ambition that I believe I couldn't be doing anything better. The potential of the future excites me. I genuinely believe entrepreneurship and venture capital as a unit accelerate the progress of humanity. There's another post coming up about that.

There are many things I want to improve on in this decade, but my only focus will be on being exceptional at investing. If I'm able to solve for investing and partnering with the best founders, everything else will solve for itself.

I will end with this exceptional quote from Denzel Washington: "Never give up. Without commitment, you'll never start. But more importantly, without consistency, you'll never finish. It's not easy. So, keep working. Keep striving. Fall down seven times, get up eight. Ease is a greater threat to progress than hardship. So, keep moving, keep growing, keep learning. See ya at work." Oooofff.... chills.

This is a long game. I've been here for a decade and I plan to stick around for as long as I can.

This is my game. I plan to be its King Kohli.

Note: All blogs posts till 2022 were migrated to this platform (react+next+tailwind). While all efforts were made to migrate wihtout any loss, the migration lost some images and broke a bunch of links in old posts. If you spot anything amiss, please notify me?